When talking agribusiness or farming with StockCo Australia’s CEO, Richard Brimblecombe, you’ll witness a true passion and youthful exuberance from a person who truly loves what he does and who he does it for. He’s spent the past five years heading up the Australian opperation of agrifinance business StockCo. In that time StockCo has seen a steady increase in its customer base on both sides of the Tasman and, as Richard talks about below, the future of the industry is looking incredibly exciting.

Tell us a little about yourself, your background and how you came to be the CEO at Stock Co.

My family had irrigation, dry land farming and grazing interests in southern Qld. After working on the family properties for a period of time I pursued a career in agribusiness, working in senior roles at Suncorp, Namoi Cotton, Landmark and CBA.

I met the founder and majority owner of StockCo’s Australian business whilst I was at CBA. I immediately fell in love with StockCo’s business model and could see a huge opportunity for StockCo to assist livestock producers by providing a new and innovative source of capital that wasn’t available from Australia’s banks. I was also drawn to the customer-centric culture and “can do” attitude that was evident across the entire team at StockCo. It was clear this was a professional organisation with an incredibly strong culture that put the customer at the centre of everything it does. I immediately wanted to be part of it and was delighted when I was offered the role as the CEO of StockCo’s Australian business.

I’ve been CEO of StockCo’s Australian business now for a little over five years. That period of time seems to have passed in a heartbeat. We now have well over 1,000 customers nationally, formal distribution agreements with Elders, Sprout Ag and Ruralco, and close working relationships with many independent agents.

It’s been a real privilege and a pleasure to develop StockCo’s Australian business and to be part of such a committed and customer focused team. The most rewarding part for me personally is that we’ve been able to help so many customers generate improved returns from their livestock businesses by providing the capital required to fully stock their existing business or to fund new business opportunities.

Can you explain the relationship between Stock Co, a client and their bank?

This is an important question because it goes to the heart of StockCo’s business philosophy. Firstly, StockCo is not a market disrupter like, for example, Uber.

StockCo’s focus is to enhance our customers’ relationship with their bank rather than disrupt it. We only provide funding for livestock. We don’t provide term loans, overdrafts, equipment finance or transaction banking services. Therefore we don’t compete with banks. We structure our security arrangements so that we don’t interfere with the security arrangements already in place between our customer and their bank. StockCo focuses on clients who enjoy a good working relationship with their bank, but who may not be able to access all of the funding they require to fully stock their existing livestock enterprise or to fund expansion plans. Our focus is to provide the additional capital that our customers require, but that which their bank may not be able to approve for them.

This enables our customers to fully stock their existing properties or feedlots or enables them to purchase or lease additional properties and direct bank funding to ongoing property development. This translates into a win : win situation for both our customers and their banks. StockCo’s philosophy is to work in with customers and their banks so that everyone wins.

What trends are you seeing in Australia at the moment?

Currently, we are in a positive part of the commodity price cycle and StockCo is assisting our customers to make the most of the current good prices. Australia enjoys providence as a clean, green producer of high-quality food products. This should lead to sustained demand for our produce for the longer term from premium markets.

On a more general level, Australian livestock producers are right on the edge of a transformational technology revolution. We see huge opportunities at the moment across a broad spectrum of areas, from livestock genetics, plant and pasture genetics, to enhancements in nutrition, management and husbandry techniques. Right now, casting our eye over the horizon, we are excited about the concept of virtual fences and real-time tracking of livestock movements.

We will be watching these developments with interest as they have the potential to unleash tremendous productivity gains. Livestock producers are able to access more and more information on their computer or on their phone, meaning access to reliable and fast internet connections are becoming vital. This is translating into improved information flows, resulting in better management decisions and improved risk management. We think there is great scope for producers to increase the intensity of their operations, whilst simultaneously strengthening the sustainability of their businesses.

It’s an incredibly exciting time and we are delighted to be playing a role in assisting our customers to take advantage of the emerging opportunities.

From your experience what are the most common difficulties farmers experience and how does StockCo help them?

Livestock prices have improved significantly over the past three years. This has resulted in improved cash flows for livestock producers. We see many producers are not running their livestock operations at full capacity because they have struggled to access the capital to fund the increased cost of the livestock.

Working capital has been tied up in a significantly higher value of livestock on hand and many producers are carrying less than optimal numbers of stock for no other reason than it has been difficult to access sufficient capital to fund the livestock. So just at the time where producers have a tremendous opportunity to maximise revenue flows, they are finding it difficult to access the capital to fund the livestock that will generate those improved cash flows.

StockCo provides the capital solution that allows clients to maximise income from their livestock operation at a time when profitability is at historically very high levels. This can, in turn, enable producers to accelerate property development programs and bring forward stronger cash flows.

What else should we know about StockCo?

Many people don’t realise that StockCo has been around since 1995. We tend to be viewed as a new market entrant, however, we have been operating continuously servicing livestock markets in Australia and New Zealand for 22 years. Whilst we have been operating in Australia for a long time we made a conscious decision in 2014 to pivot our focus to growing the Australian business and we have experienced a lot of growth in the past three years, however, our fundamental business model has been operating for a long time.

Learn more about the StockCo team here.

Figure 1 shows a rather boring CBOT wheat chart. Recent swings in prices have been small on an historical scale. As the volume of supplies dampens any attempts at a real price rally.

Figure 1 shows a rather boring CBOT wheat chart. Recent swings in prices have been small on an historical scale. As the volume of supplies dampens any attempts at a real price rally. There has been intermittent interest in Canola, ASW and Feed Barley in recent weeks, with some growers managing $10-20 premium on published bids when buyers are trying to fill ships. If you’ve got wheat in store it’s worth looking at the shipping stem to see when boats are going and trying your luck with offers on Clear, or by talking to buyers or brokers.

There has been intermittent interest in Canola, ASW and Feed Barley in recent weeks, with some growers managing $10-20 premium on published bids when buyers are trying to fill ships. If you’ve got wheat in store it’s worth looking at the shipping stem to see when boats are going and trying your luck with offers on Clear, or by talking to buyers or brokers.

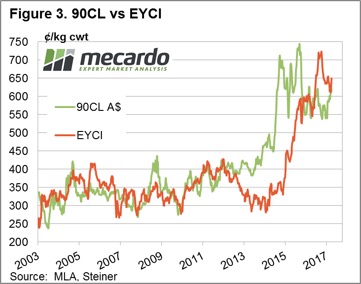

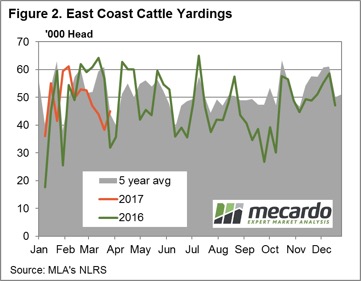

Figure 1 shows that the strong prices failed to draw out more cattle this week, with East Coast cattle yardings increasing just 1,300 head. Cattle yardings were down 28% on the same week last year. In fact almost every week of autumn (except for Easter) 2016 saw yardings above 60,000 head. Over the last 8 weeks cattle yardings haven’t managed to crack 52,000 head.

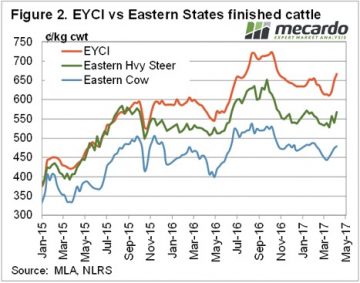

Figure 1 shows that the strong prices failed to draw out more cattle this week, with East Coast cattle yardings increasing just 1,300 head. Cattle yardings were down 28% on the same week last year. In fact almost every week of autumn (except for Easter) 2016 saw yardings above 60,000 head. Over the last 8 weeks cattle yardings haven’t managed to crack 52,000 head. Slaughter cattle prices haven’t managed to hit new 2017 highs yet. Heavy steers bounced back this week, gaining 27¢ on the east coast to sit just below the opening price of 2017, at 568¢/kg cwt. It’s s similar story for Cows, with prices sitting a few cents below the February high.

Slaughter cattle prices haven’t managed to hit new 2017 highs yet. Heavy steers bounced back this week, gaining 27¢ on the east coast to sit just below the opening price of 2017, at 568¢/kg cwt. It’s s similar story for Cows, with prices sitting a few cents below the February high.

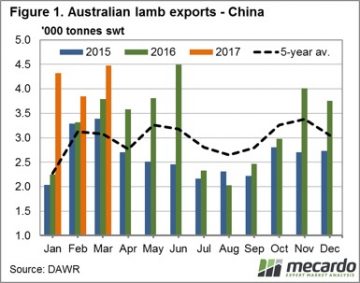

Figure 1 shows the lamb export volumes for 2017 sitting at 49% above the seasonal five year average levels for this quarter. Volumes increased again for March to 4,477 tonnes swt, just shy of the record high in June 2016. This is deviating from the usual March drop that occurs towards the seasonal trough.

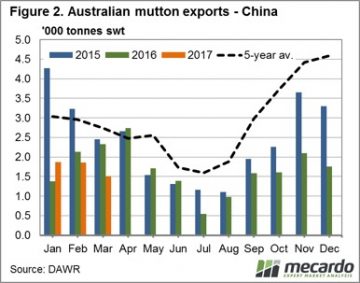

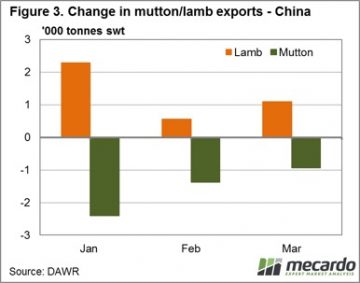

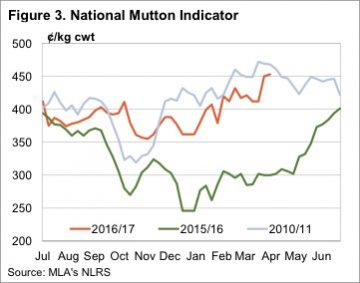

Figure 1 shows the lamb export volumes for 2017 sitting at 49% above the seasonal five year average levels for this quarter. Volumes increased again for March to 4,477 tonnes swt, just shy of the record high in June 2016. This is deviating from the usual March drop that occurs towards the seasonal trough. To delve a little deeper into the question, in Figure 3 we have lined up the change in mutton and lamb export volumes from 2015 to 2017 for the season so far. Interestingly, we can see that where mutton volume has dropped off very closely aligns with increases in lamb consignments. Particularly in the months of January and March, there is a near exact shift in volumes from the one sheep meat to the other.

To delve a little deeper into the question, in Figure 3 we have lined up the change in mutton and lamb export volumes from 2015 to 2017 for the season so far. Interestingly, we can see that where mutton volume has dropped off very closely aligns with increases in lamb consignments. Particularly in the months of January and March, there is a near exact shift in volumes from the one sheep meat to the other. Our current sheep meat export prices may also be playing a part in the changing trade trends within China. Over the last season, the basis of the spread between mutton and lamb has narrowed significantly. In 2015, we had the price of mutton at around 50% of lamb but now we’re seeing the mutton price close in.

Our current sheep meat export prices may also be playing a part in the changing trade trends within China. Over the last season, the basis of the spread between mutton and lamb has narrowed significantly. In 2015, we had the price of mutton at around 50% of lamb but now we’re seeing the mutton price close in.

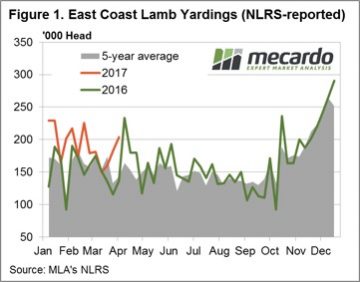

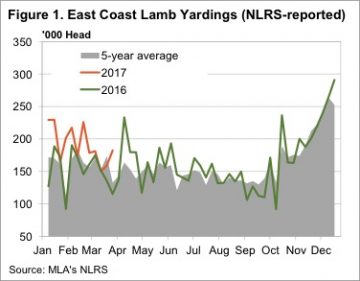

Figure 1. shows the rising trend over the last few weeks in East coast lamb throughput with a further 21,000 head added to yarding numbers this week to reach just short of 204,000 head. Since the recent dip in mid-March, lamb throughput has risen 35.4% in response to the firmer prices on offer at the saleyard.

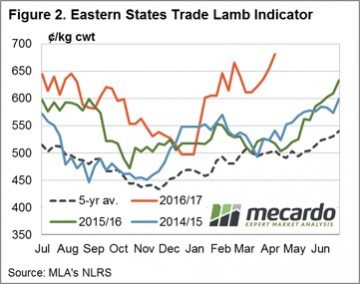

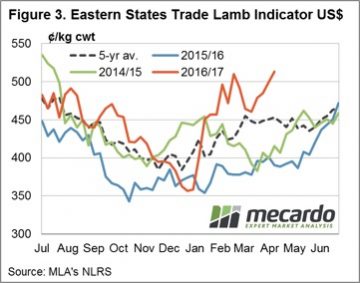

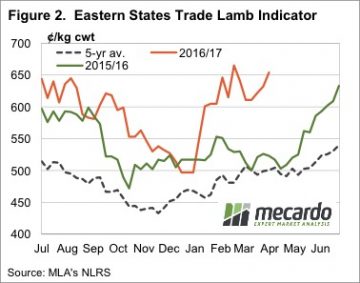

Figure 1. shows the rising trend over the last few weeks in East coast lamb throughput with a further 21,000 head added to yarding numbers this week to reach just short of 204,000 head. Since the recent dip in mid-March, lamb throughput has risen 35.4% in response to the firmer prices on offer at the saleyard. In US$ terms, lamb prices have reached a seasonal peak at 513US¢/kg cwt, this is only the second week it has been above 500US¢ this year – Figure 3. Despite the record local prices for Aussie lamb being received by producers at the moment lamb prices in US terms have been a lot higher. During the 2010/11 season our lamb in US terms reached toward 675US¢/kg cwt so at current levels it is still 24% off its all-time highs.

In US$ terms, lamb prices have reached a seasonal peak at 513US¢/kg cwt, this is only the second week it has been above 500US¢ this year – Figure 3. Despite the record local prices for Aussie lamb being received by producers at the moment lamb prices in US terms have been a lot higher. During the 2010/11 season our lamb in US terms reached toward 675US¢/kg cwt so at current levels it is still 24% off its all-time highs.

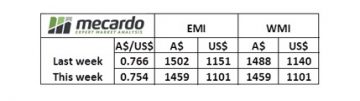

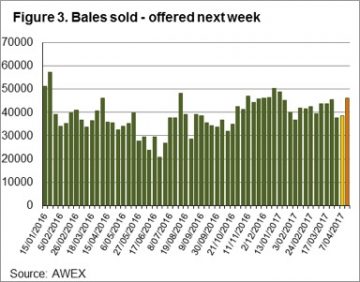

The EMI closed down 43 cents in A$ terms at 1449¢ and also softer in US$ terms at 1101¢, down 50¢. In Fremantle, the later selling time and strong finish to the week resulted in an indicator less effected with a 29¢ decline in A$. terms for the week – Fig 1.

The EMI closed down 43 cents in A$ terms at 1449¢ and also softer in US$ terms at 1101¢, down 50¢. In Fremantle, the later selling time and strong finish to the week resulted in an indicator less effected with a 29¢ decline in A$. terms for the week – Fig 1. The reversal on Thursday saw the EMI gain 2 cents, however the WMI finished plus 19 cents for the day with reports of a strong finish to the market. Gains were across the Merino combing section, 18 MPG plus 16 and 21 plus 19 cents in Melbourne.

The reversal on Thursday saw the EMI gain 2 cents, however the WMI finished plus 19 cents for the day with reports of a strong finish to the market. Gains were across the Merino combing section, 18 MPG plus 16 and 21 plus 19 cents in Melbourne. It seems that the falls on Wednesday encouraged exporters to book business and when they returned on Thursday to a reduced offering we saw the resultant rally. This caused the pass-in rate to fall compared to Wednesday, in Fremantle for example the first day a total of 29% was passed-in, however the next day this rate fell to 11.4%. Also impacting was the withdrawal of 20% in reaction to the price falls of the previous day.

It seems that the falls on Wednesday encouraged exporters to book business and when they returned on Thursday to a reduced offering we saw the resultant rally. This caused the pass-in rate to fall compared to Wednesday, in Fremantle for example the first day a total of 29% was passed-in, however the next day this rate fell to 11.4%. Also impacting was the withdrawal of 20% in reaction to the price falls of the previous day. Wool producers are not in any hurry to sell wool if the market retraces like this week, and conversely, they have been keen to sell wool as the market rallied.

Wool producers are not in any hurry to sell wool if the market retraces like this week, and conversely, they have been keen to sell wool as the market rallied. In nautical terms, dead calm is the absence of wind or waves. It feels that way at the moment in the grain trade. The market has largely drifting with little in the way of wind or waves to give momentum in any direction. Will the USDA & IGC report provide some wind behind our sails?

In nautical terms, dead calm is the absence of wind or waves. It feels that way at the moment in the grain trade. The market has largely drifting with little in the way of wind or waves to give momentum in any direction. Will the USDA & IGC report provide some wind behind our sails? Yesterday the International Grain Council (IGC) released their global crop forecasts, and although not particularly positive for prices, does provide some hope for the future. The report indicates that in 2017/18 global wheat production would fall from 745mmt to 735mmt, with end stocks to be around 484mmt versus 513 this year. It has to be tempered that this would still remain the 2nd highest stocks in history. However, it does start to show a depletion in global stocks.

Yesterday the International Grain Council (IGC) released their global crop forecasts, and although not particularly positive for prices, does provide some hope for the future. The report indicates that in 2017/18 global wheat production would fall from 745mmt to 735mmt, with end stocks to be around 484mmt versus 513 this year. It has to be tempered that this would still remain the 2nd highest stocks in history. However, it does start to show a depletion in global stocks.

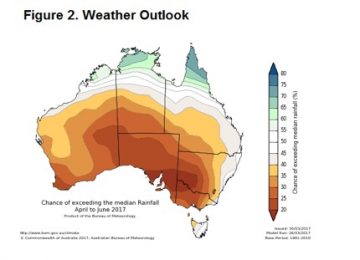

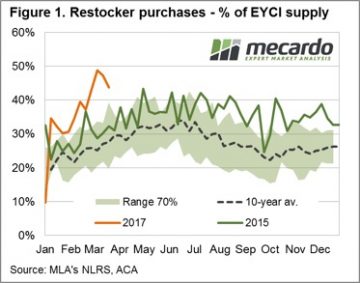

Anecdotal reports of revived restocker activity within the young cattle market suggest that recent rainfall may have given a boost to prices along the Eastern seaboard. But does the underlying data for the Eastern Young Cattle Indicator (EYCI) show this to be the case and if so, is it evenly spread across the Eastern states? Is just a simple glance at the broad restocker activity all that is needed to give a robust picture of the market or is it central to beef analysis to delve a bit deeper into the figures?

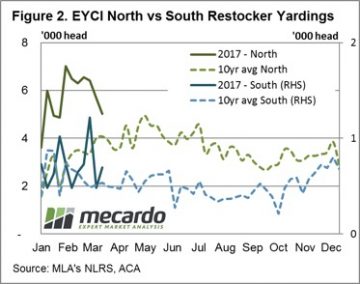

Anecdotal reports of revived restocker activity within the young cattle market suggest that recent rainfall may have given a boost to prices along the Eastern seaboard. But does the underlying data for the Eastern Young Cattle Indicator (EYCI) show this to be the case and if so, is it evenly spread across the Eastern states? Is just a simple glance at the broad restocker activity all that is needed to give a robust picture of the market or is it central to beef analysis to delve a bit deeper into the figures?  Using the underlying EYCI data we are also able to filter and analyse specific components of the broader EYCI market to determine if the robust restocker demand this season is stemming from a particular region. Separating EYCI restocker purchases into northern and southern saleyard groups, with Dubbo saleyard marking the mid-way point between North and South, we can assess how evenly distributed the restocker activity is along the East coast.

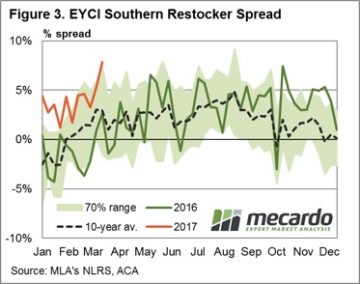

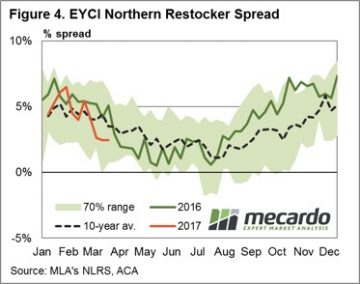

Using the underlying EYCI data we are also able to filter and analyse specific components of the broader EYCI market to determine if the robust restocker demand this season is stemming from a particular region. Separating EYCI restocker purchases into northern and southern saleyard groups, with Dubbo saleyard marking the mid-way point between North and South, we can assess how evenly distributed the restocker activity is along the East coast. Taking a look at the price spread patterns for Southern and Northern sale yards we can see that there are some stark differences between restocker activity in each region. Figure 3 shows that Southern restockers have been happy to pay a premium spread above the EYCI trending along the top of the normal seasonal range and peaking last week at 8%, equivalent to 687¢/kg cwt. In contrast, Northern restockers are paying a premium spread in the lower end of the normal range and below the seasonal average level for this time of year at 2%, equivalent to 649¢/kg cwt – figure 4.

Taking a look at the price spread patterns for Southern and Northern sale yards we can see that there are some stark differences between restocker activity in each region. Figure 3 shows that Southern restockers have been happy to pay a premium spread above the EYCI trending along the top of the normal seasonal range and peaking last week at 8%, equivalent to 687¢/kg cwt. In contrast, Northern restockers are paying a premium spread in the lower end of the normal range and below the seasonal average level for this time of year at 2%, equivalent to 649¢/kg cwt – figure 4. The above average volumes of cattle being purchased by restockers in both the North and South certainly shows the intention to rebuild the herd is evident across the Eastern seaboard. Although, considering the magnitude of destocking experienced in the North during the large turnoff during the 2013-2014 seasons the current volume of cattle going to restockers in Northern saleyards isn’t much dissimilar to levels seen last season.

The above average volumes of cattle being purchased by restockers in both the North and South certainly shows the intention to rebuild the herd is evident across the Eastern seaboard. Although, considering the magnitude of destocking experienced in the North during the large turnoff during the 2013-2014 seasons the current volume of cattle going to restockers in Northern saleyards isn’t much dissimilar to levels seen last season. Lamb prices continued to charge higher this week, despite stronger yardings. The higher prices are showing no signs of dampening demand, with some categories hitting new highs, while others eased off this week.

Lamb prices continued to charge higher this week, despite stronger yardings. The higher prices are showing no signs of dampening demand, with some categories hitting new highs, while others eased off this week. It was NSW which drove the ESTLI higher this week, as the 25¢ rise saw a new record price of 659¢/kg cwt. Light lambs in NSW saw a 42¢ rise to be the highest indicator in the land, at 673¢/kg cwt. By contrast, light lambs in SA fell 58¢ to sit at a paltry 539¢/kg cwt. For a 17kg cwt lamb that is a $23/head difference.

It was NSW which drove the ESTLI higher this week, as the 25¢ rise saw a new record price of 659¢/kg cwt. Light lambs in NSW saw a 42¢ rise to be the highest indicator in the land, at 673¢/kg cwt. By contrast, light lambs in SA fell 58¢ to sit at a paltry 539¢/kg cwt. For a 17kg cwt lamb that is a $23/head difference. The rain from Cyclone Debbie shouldn’t impact the lamb market too much, but it won’t hurt. Lamb supply out of northern NSW is likely to be disrupted, so we can expect some solid support for lamb markets. Some forward contracts for trade lambs have been floating about this week at 670¢ for May.

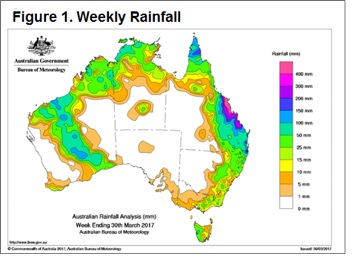

The rain from Cyclone Debbie shouldn’t impact the lamb market too much, but it won’t hurt. Lamb supply out of northern NSW is likely to be disrupted, so we can expect some solid support for lamb markets. Some forward contracts for trade lambs have been floating about this week at 670¢ for May. Figure 1 highlights the rainfall pattern across the nation this week with the impact of cyclone Debbie clearly evident. Rainfall further south also present and helping to lift restocker spirits in the southern regions as outlined in the

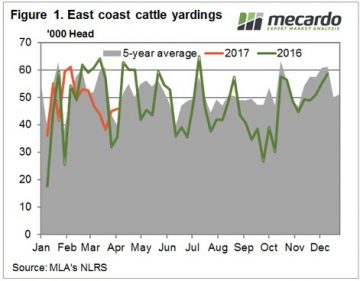

Figure 1 highlights the rainfall pattern across the nation this week with the impact of cyclone Debbie clearly evident. Rainfall further south also present and helping to lift restocker spirits in the southern regions as outlined in the  The national cattle indicators mostly higher this week with 2-4% gains recorded for all categories except heavy steers. The national heavy steer indicator dropping 3.4% on the week to close at 294¢/kg lwt. The Eastern Young Cattle Indicator (EYCI) mirroring the broader market up 4.4% on the week to close at 649.75¢/kg cwt. Young cattle prices continuing to find support from restocker buying and the added benefit of higher beef export prices, with the 90CL frozen cow up slightly – figure 3.

The national cattle indicators mostly higher this week with 2-4% gains recorded for all categories except heavy steers. The national heavy steer indicator dropping 3.4% on the week to close at 294¢/kg lwt. The Eastern Young Cattle Indicator (EYCI) mirroring the broader market up 4.4% on the week to close at 649.75¢/kg cwt. Young cattle prices continuing to find support from restocker buying and the added benefit of higher beef export prices, with the 90CL frozen cow up slightly – figure 3.