Despite the issues with slaughter capacity in South Australia it seems that we once again managed to achieve a slaughter spike in the middle week of January. In some years the weaker demand in early February has led to weaker prices, but last year it was met with weaker supply, and strong prices.

Despite the issues with slaughter capacity in South Australia it seems that we once again managed to achieve a slaughter spike in the middle week of January. In some years the weaker demand in early February has led to weaker prices, but last year it was met with weaker supply, and strong prices.

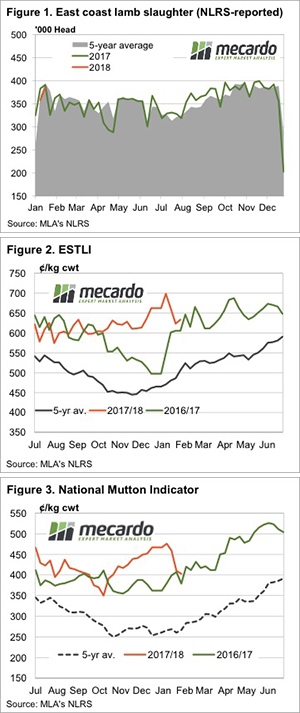

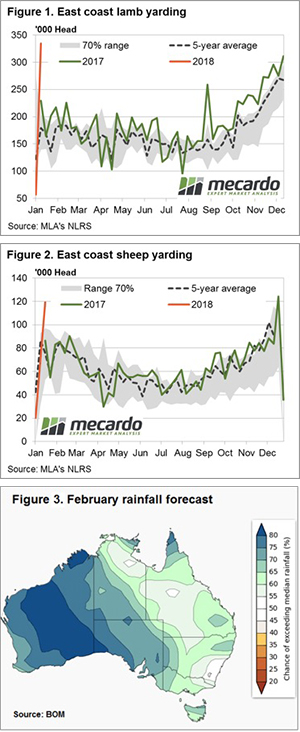

Figure 1 shows what seems quite remarkable under the circumstances. With 55,000 head of sheep and lamb slaughter capacity taken out by the TFI fire in early January, east coast processors have killed just 1.6% fewer lambs in the week ending the 19th of January.

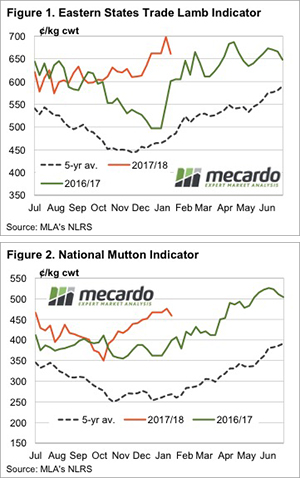

Prices did fall in that same week, which could be put down to a bit less competition, and perhaps strong over the hooks bookings in response to concerns about slaughter capacity. Last week we saw steadier prices (figure 2) as fewer lambs were yarded in response to lower prices.

Historically we see a small fall in prices at the end of January, followed by a gentle rally as lamb supply becomes tighter. Strong spring slaughter would suggest the supply trends should be similar this year, as long as demand holds on.

Mutton prices have suffered in January, and this might be where reduced slaughter capacity is hitting home. The National Mutton Indicator started the year at 470¢, and has since lost 14% to be sitting back at 400¢/kg cwt, the lowest price since early November. This could turn around as processors turn back to mutton as domestic lamb demand weakens.

What does it mean/next week?:

The lamb market seems to have found a base at the moment, at prices a little higher than this time last year. Don’t be surprised to see values track sideways from here, with a bit of volatility as the supply of finished lambs fluctuates.

There appears to be more upside for mutton given the dramatic fall it has seen, and what should be tightening supply. Some rain through NSW would obviously help bolster prices, but it looks like Queensland is going to be the beneficiary this week.

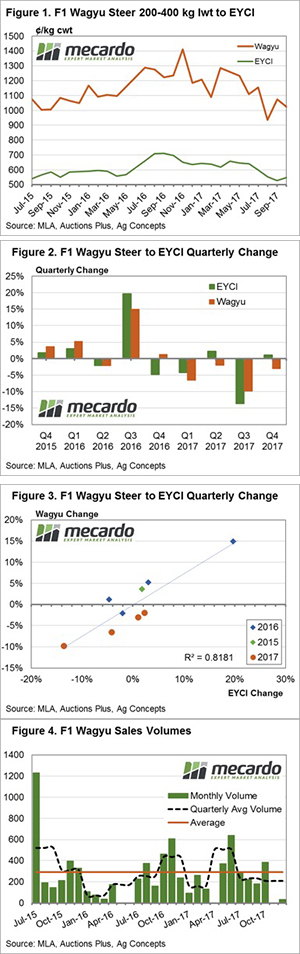

On international Star Wars day last year (May the 4th be with you) the Mecardo team took a look at Wagyu spreads to the Eastern Young Cattle Indicator (EYCI) and a recent subscriber request for a follow up article prompted us to have another look at how the 2017 season played out… and besides we couldn’t resist the chance for another pun in the heading!

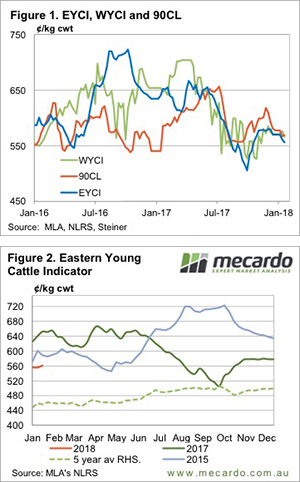

On international Star Wars day last year (May the 4th be with you) the Mecardo team took a look at Wagyu spreads to the Eastern Young Cattle Indicator (EYCI) and a recent subscriber request for a follow up article prompted us to have another look at how the 2017 season played out… and besides we couldn’t resist the chance for another pun in the heading! Weekly supply statistics showed a fairly normal pattern for the start of the season, with East coast figures hovering near to the longer term seasonal averages. Although Queensland and NSW throughput were slightly elevated for this time in the year as the Northern wet season continues to be delayed, weighing on prices.

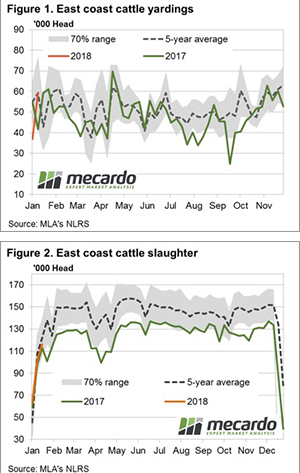

Weekly supply statistics showed a fairly normal pattern for the start of the season, with East coast figures hovering near to the longer term seasonal averages. Although Queensland and NSW throughput were slightly elevated for this time in the year as the Northern wet season continues to be delayed, weighing on prices.

For the first time in over a month we have the full suite of Meat and Livestock Australia (MLA) data to analyse. Even with all the data, the conclusions look the same. Markets are easing slightly thanks to a lack of moisture and a rising Aussie dollar.

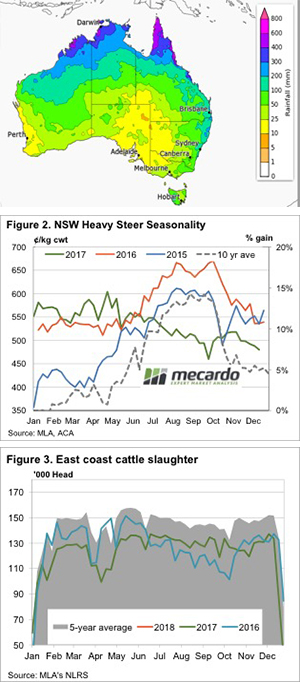

For the first time in over a month we have the full suite of Meat and Livestock Australia (MLA) data to analyse. Even with all the data, the conclusions look the same. Markets are easing slightly thanks to a lack of moisture and a rising Aussie dollar. A truck driver asked me when we were going to sell some heavy steers that we have wandering around on some still green country. My flippant response was, ‘when it rains in Queensland and the price goes up’. I then thought I’d better do the numbers and make sure this was a better than 50/50 chance of happening.

A truck driver asked me when we were going to sell some heavy steers that we have wandering around on some still green country. My flippant response was, ‘when it rains in Queensland and the price goes up’. I then thought I’d better do the numbers and make sure this was a better than 50/50 chance of happening.

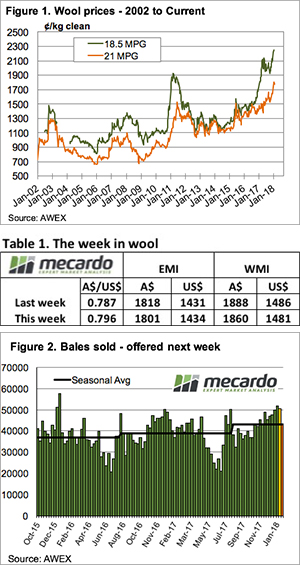

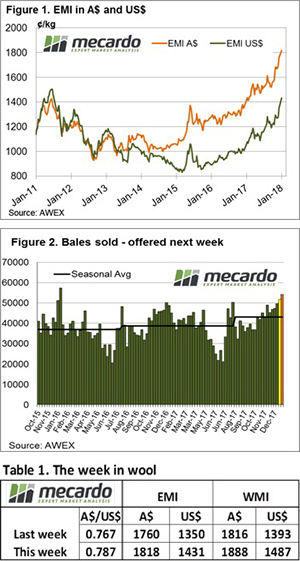

The wool market bubbled along at the higher rates reached last week, however, AWEX reported that this week buyers reverted to a more selective approach, in contrast to the past couple of sales where faults were overlooked.

The wool market bubbled along at the higher rates reached last week, however, AWEX reported that this week buyers reverted to a more selective approach, in contrast to the past couple of sales where faults were overlooked.

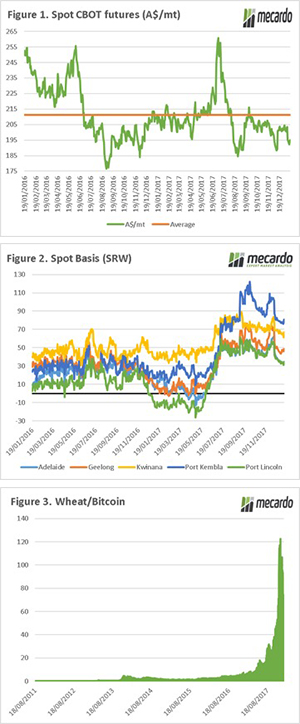

extraordinary record of 698¢/kg cwt. As the week progressed, prices cheapened, lamb indicators back in to line with the 2017 ending values.

extraordinary record of 698¢/kg cwt. As the week progressed, prices cheapened, lamb indicators back in to line with the 2017 ending values. December Merino volume was down 20% compared to 2017.

December Merino volume was down 20% compared to 2017.