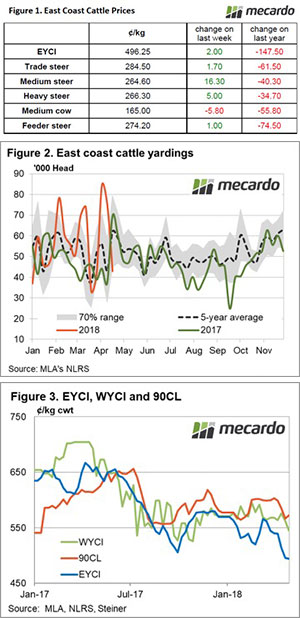

With the Beef Australia conference on in Rockhampton it looks like buyers pulled up stumps for the week and went north. This was evidenced by further declines across most cattle categories, despite some support coming from export markets.

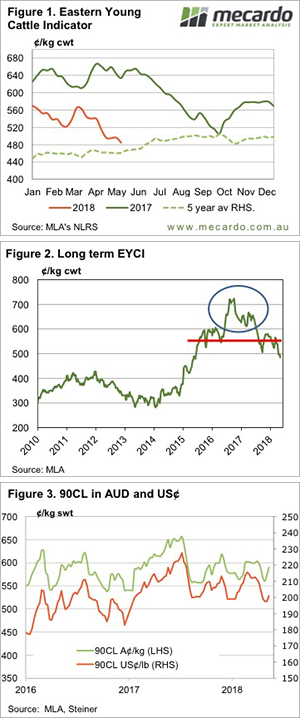

The Eastern Young Cattle Indicator (EYCI) continued its downward trajectory, posting a 13.5¢ or 2% fall to plumb new three year lows of 484.75¢/kg cwt. Our resident technical charting expert is networking in Rocky, no doubt enjoying the weather while the base in Ballarat freezes, but even to this untrained eye there are some interesting trends.

Figure 1 shows the EYCI approaching its five year average, currently sitting at a 23¢ premium. We would think the five year average should offer somewhat of a support level. Figure 2 shows the classic ‘head and shoulders’ charting pattern. We’ve just broken thorough the right shoulder, and look to be headed down the arm.

The five year average is about the elbow, let’s hope it stops there and doesn’t head down to the knees where we were back in 2014.

There was some positive news about. Figure 3 shows the 90CL export price chart we published earlier in the week, with a solid tick upwards in US prices, and the AUD falling below 75US¢, pushing our price back to 590¢/kg swt.

Additionally, most of Victoria, and South East South Australia got some good rain over the last few days. It will be particularly important for parched parts of Gippsland. These areas only account for 4 million head, or 16% of the national herd, so it’s unlikely to move the market too far.

The week ahead

There is still no rain forecast for NSW, so it’s hard to see cattle markets heading higher in a hurry until there is some relief. Grain prices also continue to charge higher, with feed grains heading towards $280-300/t and this will obviously dampen demand from lotfeeders. A real rally in cattle markets is going to require rain, and there is probably still scope for it to head lower if it remains dry.

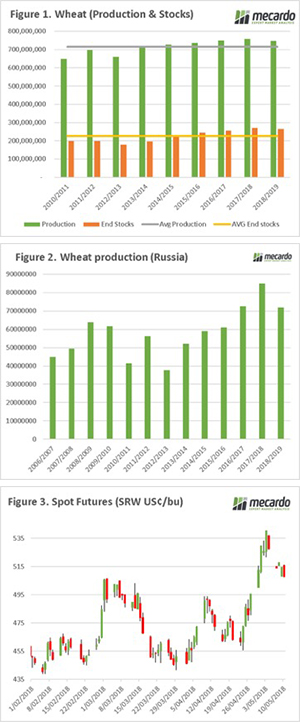

e first of the year to forecast the coming season. Although, with these initial estimates, it is probably worthwhile taking them with a pinch of salt. In figure 1, the global projections for wheat production and end stocks are displayed. These unsurprisingly show a decline in both, with production down year on year 10mmt, and end stocks 6mmt. This is slightly above most trade expectations, but there is still a long way to go.

e first of the year to forecast the coming season. Although, with these initial estimates, it is probably worthwhile taking them with a pinch of salt. In figure 1, the global projections for wheat production and end stocks are displayed. These unsurprisingly show a decline in both, with production down year on year 10mmt, and end stocks 6mmt. This is slightly above most trade expectations, but there is still a long way to go.

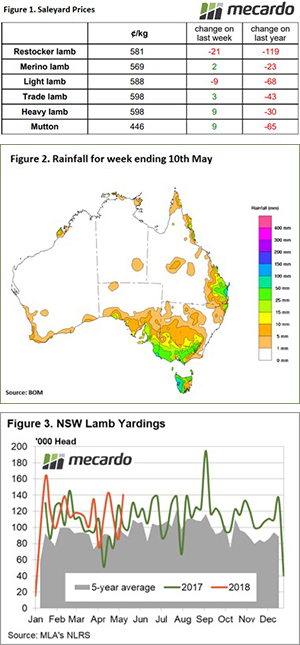

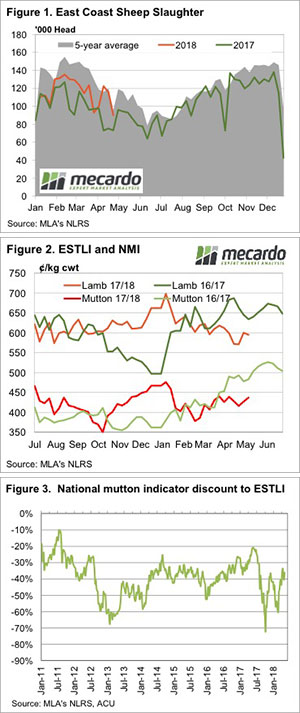

beginnings of the Autumn break, with some light falls extending into NSW – Figure 2. The arrival of the rains has certainly stemmed the decline of lamb and sheep prices in Victoria with sale yard NLRS reporting modest gains of up to 2% across nearly all categories. Victorian Restocker Lambs the exception, closing 4% softer to 573¢/kg cwt.

beginnings of the Autumn break, with some light falls extending into NSW – Figure 2. The arrival of the rains has certainly stemmed the decline of lamb and sheep prices in Victoria with sale yard NLRS reporting modest gains of up to 2% across nearly all categories. Victorian Restocker Lambs the exception, closing 4% softer to 573¢/kg cwt.

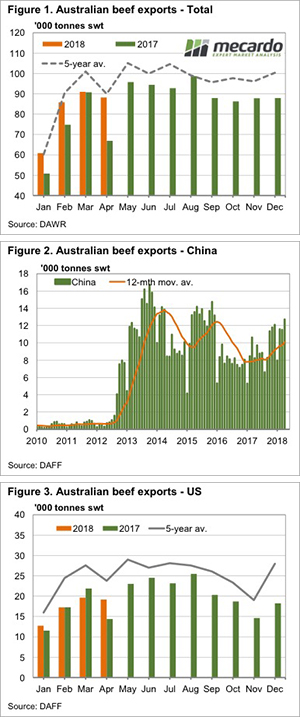

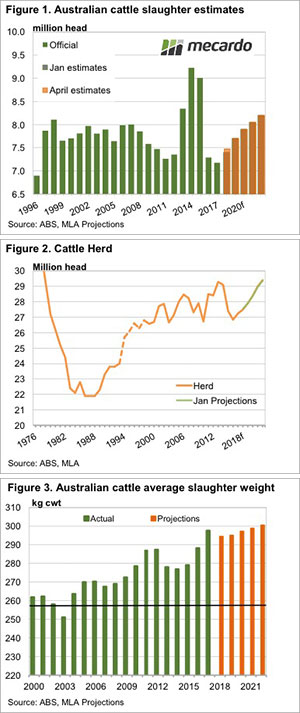

seems to be finding homes in export markets. Demand for Australian beef remains relatively robust. Figure 1 shows April beef exports were down a marginal 3% on March thanks to public holidays. Exports were however, 32% higher than April last year, and at a four year high for the month.

seems to be finding homes in export markets. Demand for Australian beef remains relatively robust. Figure 1 shows April beef exports were down a marginal 3% on March thanks to public holidays. Exports were however, 32% higher than April last year, and at a four year high for the month.

the majority of the worlds crop being in the growth phase. After six years of strong production, the weather strikes back.

the majority of the worlds crop being in the growth phase. After six years of strong production, the weather strikes back.

going forward.

going forward.