A lot of talk little movement

The Chicago wheat market found a bit of strength this week on the back of some less than ideal sowing weather. This sees spring crop going in late, and the spectre of some areas not getting in at all. All this despite another relatively bearish WASDE report.

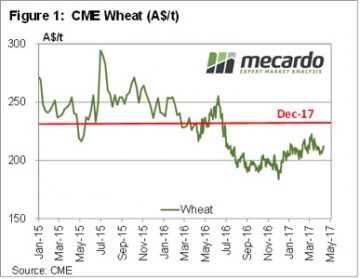

In reality, price movements were small in international markets this week. But after months of tracking sideways at low levels, commentators need something to talk about. CBOT wheat gained 9¢ over a few sessions, to hit a two week high of 432¢/bu. In our terms this puts spot wheat at $212/t (figure 1), and December 17 at $235.

In reality, price movements were small in international markets this week. But after months of tracking sideways at low levels, commentators need something to talk about. CBOT wheat gained 9¢ over a few sessions, to hit a two week high of 432¢/bu. In our terms this puts spot wheat at $212/t (figure 1), and December 17 at $235.

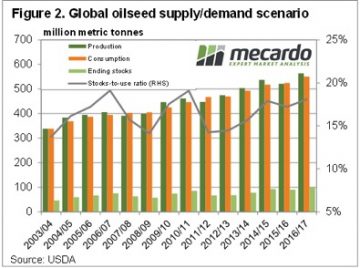

In oilseeds the usually benign April WASDE report threw up a few surprises. The USDA increased Brazilian soybean production by nearly 3mmt, which had the flow on effect of increasing global ending stocks by 5.6% (figure 2). This was well beyond expectations and saw soybeans fall around 10¢, before recovering to actually post a gain for the week.

ICE Canola followed soybeans lower, but changes were marginal with Jan 18 sitting at $481/t. With the AUD/CAD currently at parity it’s not hard to work out what the price is in our terms.

Locally there is little going on in markets. Wheat, barley and canola prices continue to track sideways as growers and buyers continue the standoff. Growers say they need higher prices, buyers know there is heaps of wheat out there which has to be sold at some stage.

The week ahead

The coming month sees the USDA release their first estimate for the 2017/18 growing season, and this can often bring volatility to the market. There is no doubt US wheat production is going to be lower, but whether this can move the market remains to be seen.

The coming month sees the USDA release their first estimate for the 2017/18 growing season, and this can often bring volatility to the market. There is no doubt US wheat production is going to be lower, but whether this can move the market remains to be seen.

In the short term selling opportunities continue to revolve around export deadlines and delivered markets.