The US grain market gets plenty of attention usually, however in recent times it is the clearly dominant story, and for good reason. Politics is impacting, with a massive export program to China under the Phase 1 deal a big story, we also have the current harvest and crop outlook to contend with. Throw in the dealing from the US government of huge farm subsidies and there is plenty to feed grain news stories.

The scale of the farmer “aid” is huge, with the Trump administration announcing a total of $28 billion in aid for farmers in 2018 and 2019, funds the president says come from the tariffs levied on China. The administration secured another $23.5 billion to help American farmers through the $2 trillion coronavirus stimulus package passed in March.”

While this type of support is never going to occur in Australia, it has impacts on our price and market access.

The other big issue is the China Phase 1 deal, and depending which day it is or which diplomat is speaking it is either going ahead “full steam”, or about to be dumped. This is a big factor for all grain producing and importing countries, China agreed to purchase between $40 billion and $50 billion of U.S. agricultural goods in each of the next 2 years.

If the deal goes ahead, the rest of the world’s grain exporting nations will search for other markets; if the deal collapses China will scramble for replacement products.

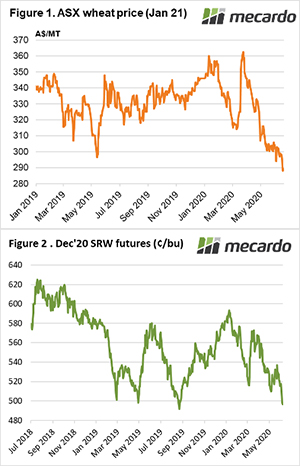

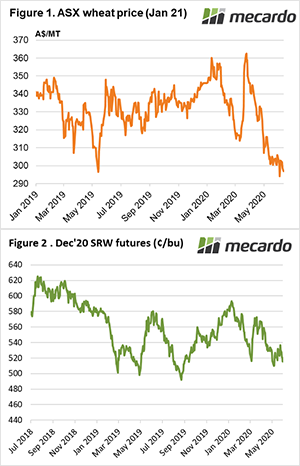

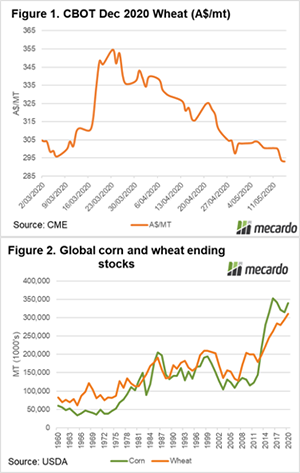

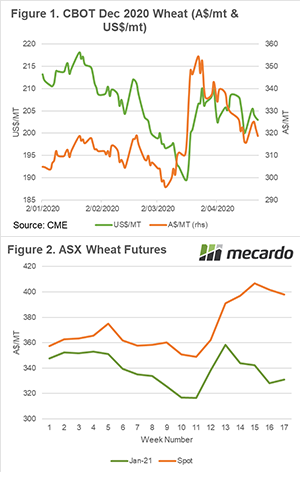

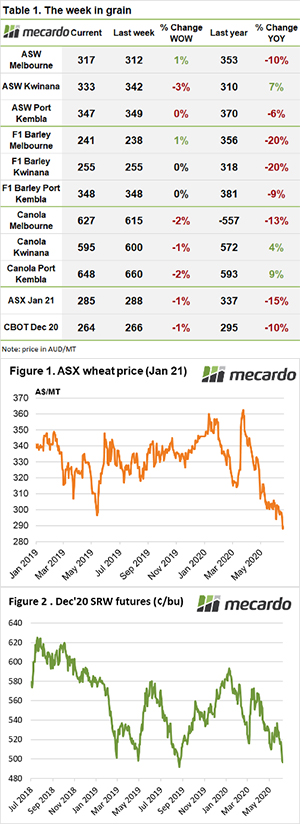

Harvest in the northern hemisphere is ramping up, and by-and-large the results are positive for supply, which means negative for price. All markets are tending softer, with the exception of the European rapeseed/canola market where production disruptions are impacting locally. However, in Russia and France good harvest reports caused markets to soften. The CBOT SRW contract now looks well settled below 500 c/bush, losing a further cent to 485.5 cents this week.

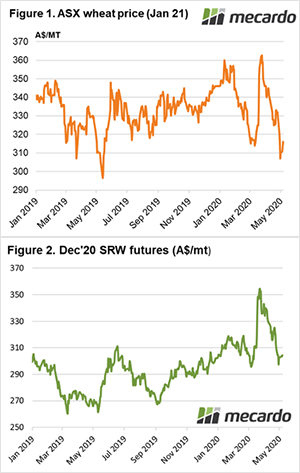

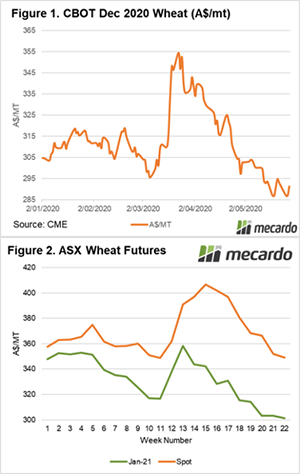

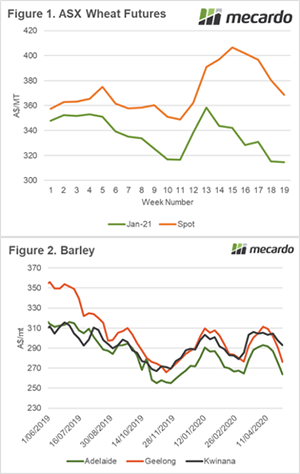

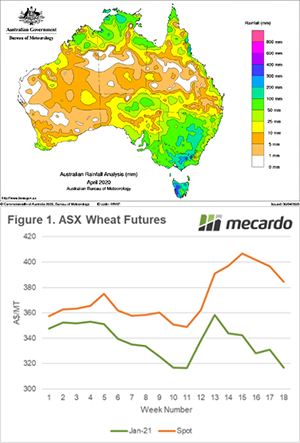

Domestically the weaker international values combined with continued good weather and the prospect of rain in July to see “new crop” prices ease around $10 for wheat & $3 for F1 barley.

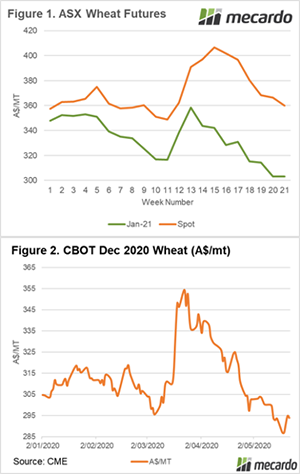

Delivered prices to Melbourne for ASW1 wheat is quoted $350 for “old crop” and $290 per tonne for “new crop”. The ASX Jan 2021 contract pulled back another 3 dollars to $285, while the US CME Dec 2020 contract also continued to retrace, ending the week just under 495 cents per bush.

Buyers seem to be in a comfortable space regarding grain requirements up to harvest and happy to let the market soften, while growers are yet to face harvest prices although the continued good seasonal outlook could encourage selling soon.

Next week?

The market is not providing any signals that prices will improve, in fact, the latest BOM weather outlook has July delivering rain that will only improve the outlook for harvest. We will keep a close watch on harvest yield reports from the Northern Hemisphere, if these continue in a positive trend expect further price weakness.