Key Points

A month is a long time in markets. A lot can happen, and opportunities can be lost or gained if you wait a month before making a decision. In this weekly update, we take a look at what has happened over the past month.

As discussed in yesterday’s analysis article volatility has increased in recent months to higher than average levels for this time of year (See: More months of uncertainty).

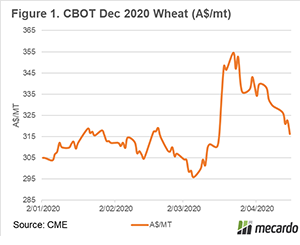

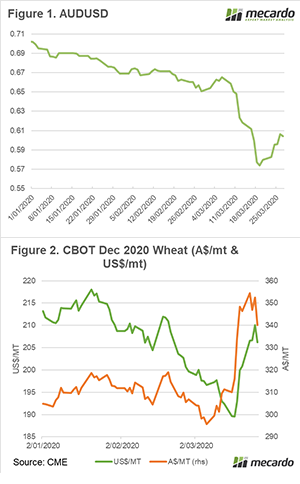

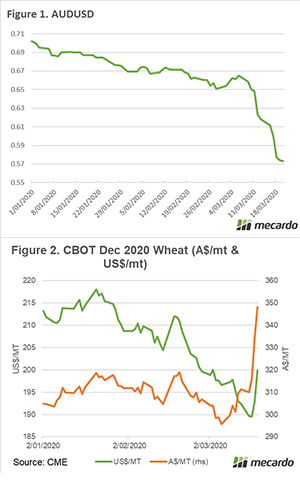

Chicago wheat futures have been in a steady decline since last Thursday, in US terms the market has fallen from US$209/mt to A$200/mt for the December contract. During the same period, the A$ has advanced to trading at a range of 63-64¢. This has resulted in December wheat futures falling from A$329/mt to A$316/mt in the same timeframe.

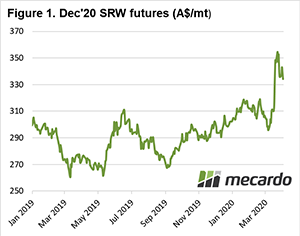

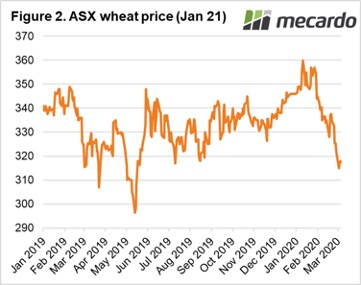

In the past month, we have seen a large fall in wheat futures levels in part due to a rising Aussie dollar and a depreciating CBOT. During the week commencing the 16th March, wheat futures rose from A$310 to A$348, and continued through the next week to reach a high of A$355 (figure 1).

The market has given back most of the gains since that point. There are many farmers who benefitted from this rally in pricing levels by taking out wheat swaps for next harvest.

It is important to develop a marketing strategy which will take the emotion out of selling decisions, this will help gain a higher overall price.

Remember to listen to the Commodity Conversation podcast by Mecardo

What does it mean/next week?:

Parts of Europe and the black sea nations have been dry. However, the next fortnight is expected to see improved rainfall.

Seeding has started in Australia, and will likely ramp up towards the traditional ANZAC day start. The majority of farmers are quietly confident of the conditions.

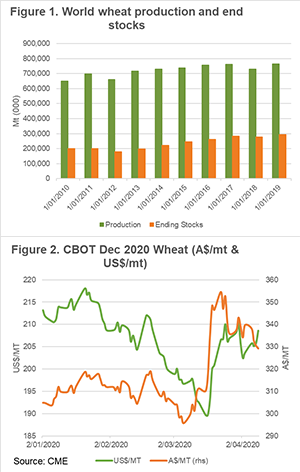

There has been a run on toilet roll in Australia, however, we will likely have plenty of cereal. In this update, we step away from COVID-19 and look at some of the fundamentals driving the market.

There has been a run on toilet roll in Australia, however, we will likely have plenty of cereal. In this update, we step away from COVID-19 and look at some of the fundamentals driving the market.