Wheat is not just wheat. There are multiple varieties bred for different purposes from durum to noodle wheat. There are also multiple futures contracts which can be used based on quality and geography. In this article we will be looking at Kansas and Chicago futures.

In order to start, its worth defining the two contracts. The Kansas contract or hard red winter wheat (HRW). The HRW wheat crop is grown in Texas, Nebraska, and Kansas. The HRW is mid protein (min 11%) and is therefore perfect for producing bread. As a winter wheat, it is planted straight after harvest (August/September) with harvest occurring during the following summer (late May/August).

In Australia most commentators refer to the Chicago contract, as it is the most heavily traded wheat contract in the world. Chicago contract is soft red winter wheat (SRW). The SRW contract is low protein, with a typical profile of 9.5%. This crop has a similar planting and harvest window to HRW and is used for pasta, animal feed and biscuits.

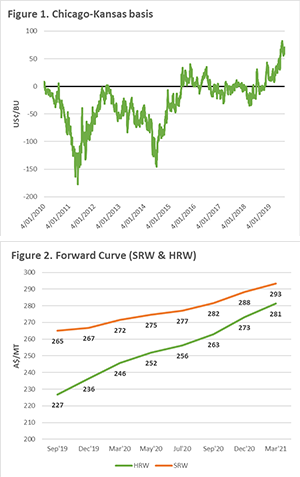

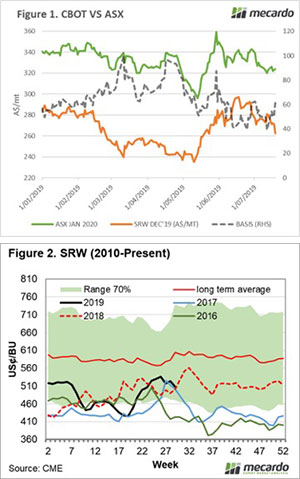

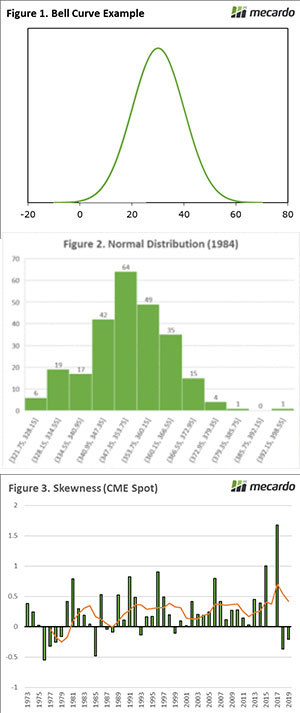

In recent years the basis between Chicago and Kansas has shown a 28¢/bu discount for Chicago wheat futures. This makes sense as Kansas wheat is a higher quality product, however in the past year we have seen Kansas futures moving to a strong discount to Chicago. This discount is currently 70¢/bu (figure 1).

In figure 2, the forward curve is shown for both contracts (in A$/mt). It is always important to examine the curve as it can provide a strong insight into hedging opportunities. As we can see the Kansas contract is at a strong discount to Chicago at present, however it does start to converge further down the horizon.

In figure 2, the forward curve is shown for both contracts (in A$/mt). It is always important to examine the curve as it can provide a strong insight into hedging opportunities. As we can see the Kansas contract is at a strong discount to Chicago at present, however it does start to converge further down the horizon.

The question at present is whether the Chicago futures will decline to meet Kansas or whether Kansas will rise to meet Chicago.

What does it mean/next week?:

At present the separate US futures contracts both provide differing opportunities for both growers and buyers.

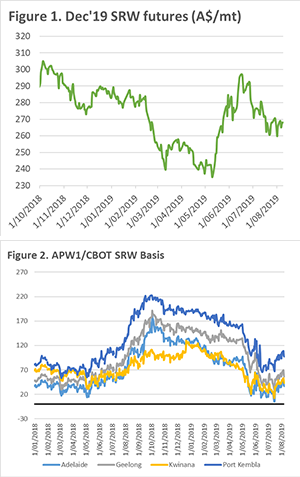

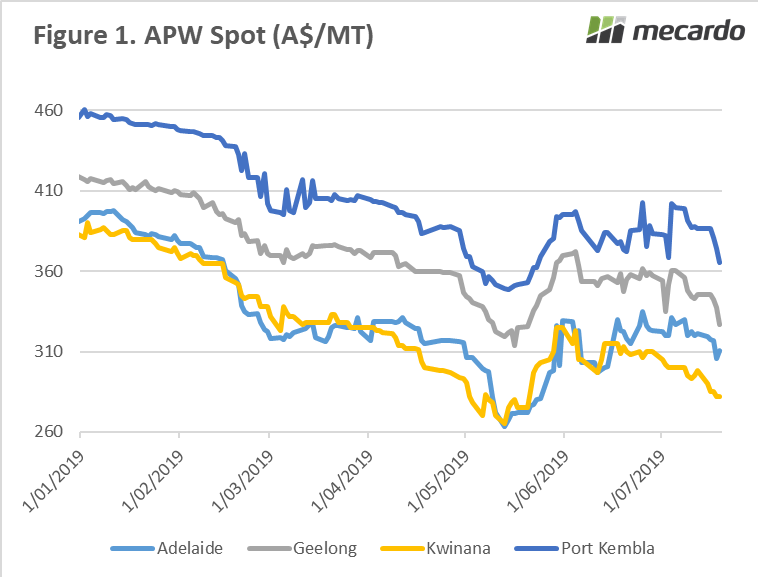

Grain growers: The Chicago contract offers a price of A$288 for December 2020 (harvest). As an Australian producer we would then include basis – which typically would be positive. However, the ASX Jan 2021 may offer better value than using overseas futures at present.

Grain buyers: There is an opportunity to buy Kansas for September at A$263. This would give protection from rallies in the US market through next year’s volatile period. Through buying the September contract, it would provide ample opportunity to lock in basis prior to harvest or use any hedge revenue against the prior year’s requirements.

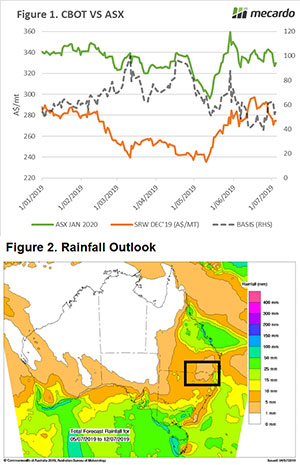

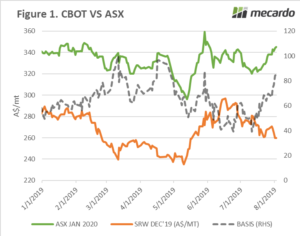

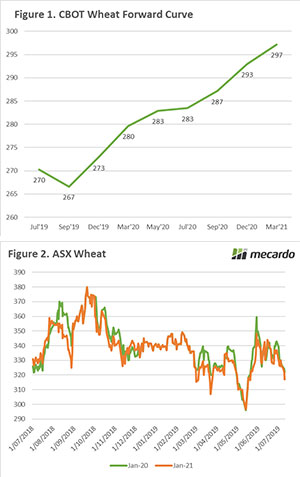

As we can see in figure 1, the gains of June have now largely dissipated with pricing levels back to mid-May levels and A$29 lower than the peak. The higher than expected yields in Europe are leading to a bearish undertone, nonetheless, the trade will be examining the forthcoming WASDE for some direction.

As we can see in figure 1, the gains of June have now largely dissipated with pricing levels back to mid-May levels and A$29 lower than the peak. The higher than expected yields in Europe are leading to a bearish undertone, nonetheless, the trade will be examining the forthcoming WASDE for some direction.

is in good condition with plenty of potential. The same story, however, cannot be said for NSW, which now can, unfortunately, be largely written off.

is in good condition with plenty of potential. The same story, however, cannot be said for NSW, which now can, unfortunately, be largely written off.

However, when we look further out to next December (2020), we can see that the futures contract is trading at A$293/mt. This may be a more attractive proposition when using CBOT futures as it provides a level which will most likely end with an overall price well above A$300/mt when basis is added.

However, when we look further out to next December (2020), we can see that the futures contract is trading at A$293/mt. This may be a more attractive proposition when using CBOT futures as it provides a level which will most likely end with an overall price well above A$300/mt when basis is added.