In recent weeks the major discussion point in the grain market has been the difficulty in planting the US corn crop due to the torrent of rainfall. However, the market has suddenly lost steam over recent days. What is happening?

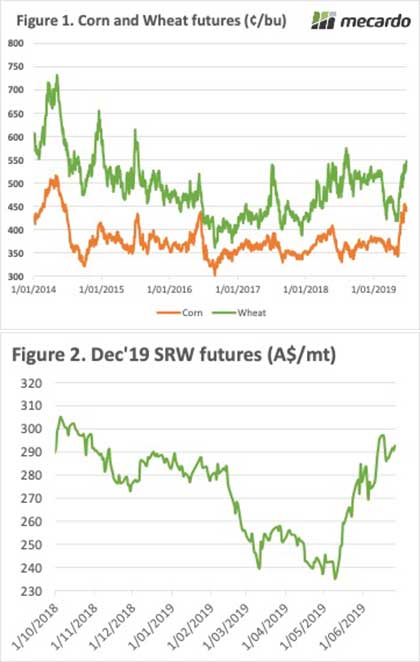

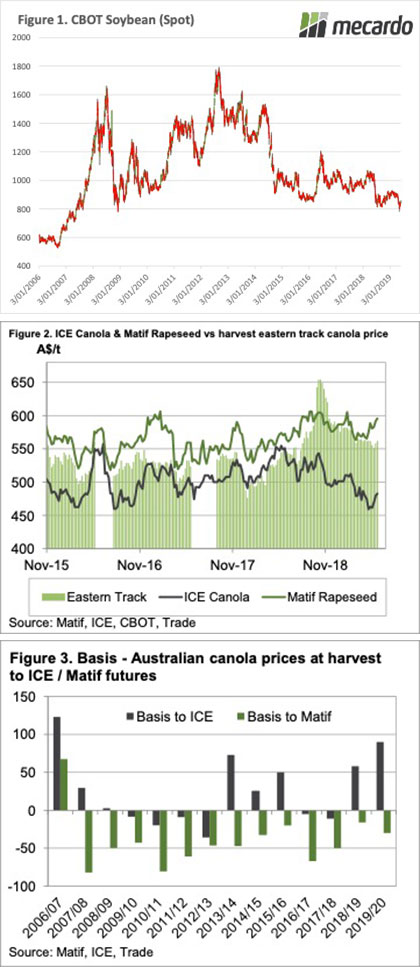

I have been asked a few times in recent weeks why the focus is on corn. Figure 1 shows the relationship between corn and wheat, which represents the returns or the weekly price change in percentage for both grains. As we can see, there is a high degree of correlation between them, which effectively means that if one goes up the other will follow (and vice versa).

This highlights the relevance of changes in corn supply and demand to wheat pricing. So why has the market suddenly fallen?

The USDA released their acreage report. This report provides an insight into the planted areas for each of the main commodities grown in the US. The biggest surprise, however, was that after all the reports of drenched paddocks and flooded rivers, corn was suddenly 3% higher year on year (Table 1).

The reason why is that the survey conducted for the acreage report was conducted in early June, at the mid-point of the monsoonal conditions. The figure also included the intended acreage from early June, which is now very unlikely to have been achieved.

The USDA has realized that the data is likely to require revision and are going to resurvey to update the figures for the crop report due to be released in August.

What does it mean?:

The algorithms which trade on data are likely to be a significant factor driving the fall in futures prices. Although on paper acreage has increased, it is highly likely that this data is erroneous and will be updated.

We may just be seeing a breather and when updated data is released there is the possibility of a rebound.

Key Points

- Corn and wheat follow one another with a strong degree of correlation.

- The acreage report shows an increase year on year to the area planted to corn.

- This data is liable for major downward revisions.