How relevant is the ESTLI?

Regular readers will know that when we talk about lamb markets, we use the Eastern States Trade Lamb Indicator (ESTLI) as a base for our analysis. The regular reporting and widespread coverage of the ESTLI make it a reliable gauge for the level and direction of the lamb market. However, with the recent launch of MLA’s new market information website, we can now drill down to saleyard level and get some specific regional spreads to help guide buying or selling decisions.

Regular readers will know that when we talk about lamb markets, we use the Eastern States Trade Lamb Indicator (ESTLI) as a base for our analysis. The regular reporting and widespread coverage of the ESTLI make it a reliable gauge for the level and direction of the lamb market. However, with the recent launch of MLA’s new market information website, we can now drill down to saleyard level and get some specific regional spreads to help guide buying or selling decisions.

The ESTLI is a broad indicator, taking in 18-22kg lambs sold at NLRS saleyards on the east coast. MLA’s excellent new market information and pricing tool allows producers to look at individual saleyard lamb weekly prices for a range of weights and buyers. It doesn’t matter what type of sheep or lamb is being sold, MLA’s tool allows you to look at last week’s price and a chart or table of up to 3 years or historical data. Additionally, the data can be exported into excel so it can be further analysed.

To give an example of how helpful this data can be, we have run some comparison of price for 20-22kg lambs, sold to processors, in Hamilton and CTLX. To get a good data, we had to merge the young lamb and old lamb prices series, and this makes it obvious when young lambs arrive in these markets. This analysis will give us an idea of how reliable the ESTLI is as an indicator for these yards at different times of year.

To give an example of how helpful this data can be, we have run some comparison of price for 20-22kg lambs, sold to processors, in Hamilton and CTLX. To get a good data, we had to merge the young lamb and old lamb prices series, and this makes it obvious when young lambs arrive in these markets. This analysis will give us an idea of how reliable the ESTLI is as an indicator for these yards at different times of year.

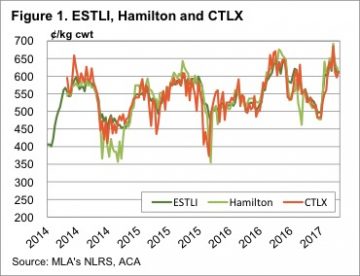

Figure 1 shows weekly prices for the ESTLI, Hamilton and CTLX lambs over the past 3 years. While prices do tend to move together, there are time when lambs Hamilton and CTLX are at significant discounts to the ESTLI. If you are selling in these centres, these times are to be avoided.

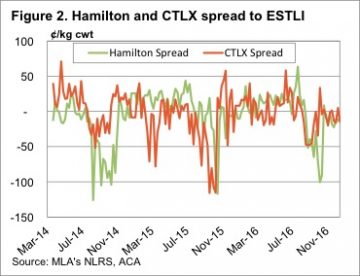

Figure 2 gives a bit clearer picture of the premiums and discounts for lambs at Hamilton and CTLX. Interestingly, both yards have an annual dip in prices relative to the ESTLI in the spring, with Hamilton seeing stronger discounts.

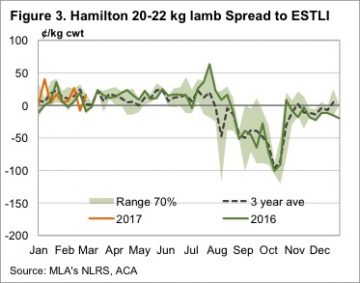

Looking at markets on an annual basis shows a clear strategy for trade lamb producers who use these saleyards. At Hamilton, there is an annual heavy discount for trade lambs to the ESTLI, starting in September and not really correcting until November. This is due to the dearth of lamb numbers, and specifically young lambs, with a critical mass not usually arriving until November, when prices generally run at a small discount to the ESTLI.

Looking at markets on an annual basis shows a clear strategy for trade lamb producers who use these saleyards. At Hamilton, there is an annual heavy discount for trade lambs to the ESTLI, starting in September and not really correcting until November. This is due to the dearth of lamb numbers, and specifically young lambs, with a critical mass not usually arriving until November, when prices generally run at a small discount to the ESTLI.

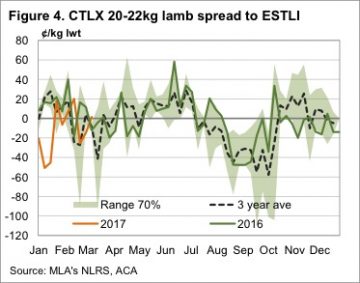

At CTLX (figure 4) the trend is similar, but discounts are not as heavy, while lambs command a premium to the ESTLI in late spring, when a bulk of the ESTLI supply is coming from Victoria.

Key points:

- MLA’s new market information tool allows detailed analysis of individual saleyard prices relative to the ESTLI.

- Both Hamilton and CTLX experience discounts to the ESTLI in early spring, before new season lambs arrive.

- The ESTLI is a reliable price indicator for these yards except for the early spring, when alternative markets should be sought.

What does this mean?

The brief analysis tells us that for most of the year the ESTLI is a good indicator of prices at Hamilton and CTLX. When lamb prices move to heavy discounts to the ESTLI is when there aren’t many lambs being sold. This tells us that if we are going to sell lambs in early spring, these saleyards might not be the best option.

The brief analysis tells us that for most of the year the ESTLI is a good indicator of prices at Hamilton and CTLX. When lamb prices move to heavy discounts to the ESTLI is when there aren’t many lambs being sold. This tells us that if we are going to sell lambs in early spring, these saleyards might not be the best option.

We can also see that strong premiums to the ESTLI don’t last long in either saleyard. Either the rest of the market catches up, or yardings increase to see prices fall the following week. Either way the market corrects.

This data is available for all NLRS reported markets, and can be a valuable took in looking at market trends, and timing sales.