Input update: Fertilizer and Fuel (Jan 2017)

Key Points

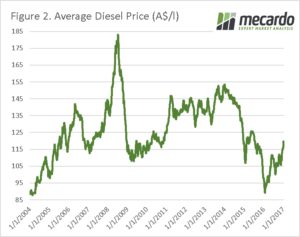

- The August-November average diesel price at port was $106/l

versus $116 for the past month.

- There is a global glut of fertilizers on the market which is unlikely to rectify anytime soon.

The harvest is all but done, now is the time to start looking towards next year. There will be changes in planting, a little more of this and a little less of that. However, regardless of what you plant you will be burning diesel and spreading fertilizer. In this report, we look at these two important inputs.

In the last two months’ millions of litres of diesel

will have been burnt across the grain growing regions

of Australia, and in reality, we are only a few months

away from starting all over again with seeding and

the diesel bills will start flowing in. In figure 1,

the average port diesel price for Australia is

displayed since the start of 2015. Assuming that

most farmers purchased their fuel well in advance

of harvest as recommended by Mecardo early in 2016,

the input costs for fuel for the 2016/17 harvest

will be considerably lower than current levels.

The average diesel price for Aug/Nov was A$106/l,

versus A$116/l for the past month. Although diesel is

creeping back up diesel prices have spent a lot of the

last ten years above current levels (figure 2). In late

December OPEC agreed for the first time in eight

years to cut oil production, which alongside improving

economic conditions has led to an increase in crude

oil prices and therefore diesel. The market for oil is

hard to predict and in coming months it is important

to keep a close eye on the market with a view to

locking in fuel for the coming season either through

swaps or fuel contracts.

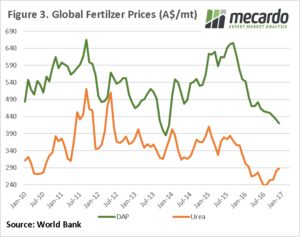

The picture is rosier when it comes to fertilizer. In

figure 3, we can see that both DAP and Urea are both

pricing at good levels since the start of the decade.

Although Urea has seen an uptick in past months, the

outlook for fertilizer supply still points to a surplus for

at least the next two to three years. The supply issue

aside the real risk is a fall in the A$ increasing the

cost of imports.

What does it mean?

The fertilizer market remains at low levels; however,

the market outlook remains bearish to neutral reducing

the impetus to go out straight away and stock up.

In terms of fuel the outlook is less certain, and looking in

a proportion of fuel requirements in advance could be an

advisable risk management strategy.