Throughput eases as cattle prices soften

Weekly east coast cattle slaughter draws closer to this seasons peaks and throughput eases as producers respond to lower cattle prices with all national cattle indicators and the Eastern Young Cattle Indicator (EYCI) all registering declines this week.

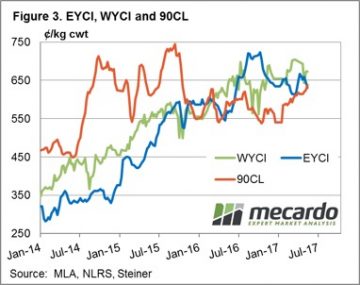

In contrast to the declining throughput and price movements, weekly East coast slaughter for the period ending 5th May still managing an increase from the previous week’s numbers as processors increase activity post the shortened Easter and ANZAC holiday periods – Figure 1. Weekly cattle slaughter rising 14.5% to just over 125,000 head, not far off the peak slaughter levels experienced during March.

In contrast to the declining throughput and price movements, weekly East coast slaughter for the period ending 5th May still managing an increase from the previous week’s numbers as processors increase activity post the shortened Easter and ANZAC holiday periods – Figure 1. Weekly cattle slaughter rising 14.5% to just over 125,000 head, not far off the peak slaughter levels experienced during March.

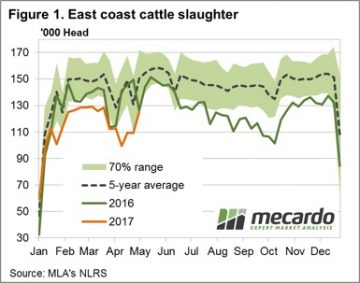

After the spike in throughput along East coast saleyards last week producers respond to the softer price pattern with an 13.5% fall in yardings noted to see 60,332 head change hands. Despite the decline yardings reported this week still the second highest weekly figure so far this season and at the higher end of the normal seasonal range for this time of the year, suggesting that demand remains relatively firm as the price declines haven’t been excessive – figure 2.

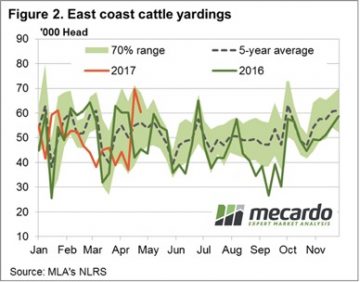

Indeed, the Western cattle markets were broadly stable, while only marginal declines cited in the East for young/store cattle. The EYCI down a mere 1.5% on the week to 634¢/kg cwt – figure 3. In national markets, trade steers less than 1% softer (345¢/kg lwt), feeder steers declined 1.8% (342¢/kg lwt), while medium cow shed a mere 2.1% (216¢/kg lwt). The more moderate falls reserved for the heavier end with medium steers leading the charge recording a 5% fall at 292¢/kg lwt, while heavy steers (not so heavy it seems) posting a 2.6% drop to 293¢/kg lwt.

Indeed, the Western cattle markets were broadly stable, while only marginal declines cited in the East for young/store cattle. The EYCI down a mere 1.5% on the week to 634¢/kg cwt – figure 3. In national markets, trade steers less than 1% softer (345¢/kg lwt), feeder steers declined 1.8% (342¢/kg lwt), while medium cow shed a mere 2.1% (216¢/kg lwt). The more moderate falls reserved for the heavier end with medium steers leading the charge recording a 5% fall at 292¢/kg lwt, while heavy steers (not so heavy it seems) posting a 2.6% drop to 293¢/kg lwt.

The week ahead

As figure 3 outlines, a firmer 90CL beef export price as the US market demand begins to fire up should lend some support to cattle prices into next week. The 90CL another 2% higher to close at 637.6¢/kg CIF should start to provide some enthusiasm to processors. The 90CL posting a fourth successive week on week gain and has lifted 3.9% since mid-April.