A recovery in slaughter figures as we move away from the shortened Easter and ANZAC weeks noted, but not enough to dampen demand as prices for young, store and heavy cattle lift slightly over the week.

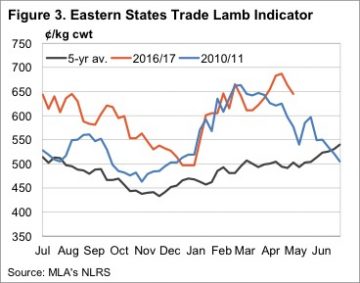

Figure 1 shows the seasonal pattern for East coast slaughter for the week ending 21st April. While the numbers don’t yet represent the shortened ANZAC week it is still clear to see the recovery in supply after the Easter dip. East coast slaughter for the week rising to 109,500 head, a 10% increase from the previous release.

Figure 1 shows the seasonal pattern for East coast slaughter for the week ending 21st April. While the numbers don’t yet represent the shortened ANZAC week it is still clear to see the recovery in supply after the Easter dip. East coast slaughter for the week rising to 109,500 head, a 10% increase from the previous release.

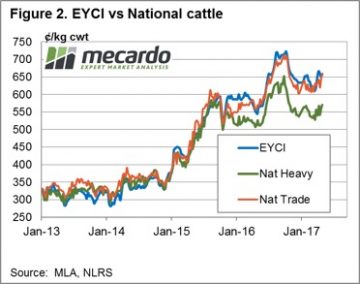

Improved throughput and slaughter unable to weigh too heavily on prices with the Eastern Young Cattle Indicator (EYCI) lifting slightly to close nearly 9¢ higher at 659¢/kg cwt. East coast heavy steers showing a similar lift up 7¢ to 308¢/kg lwt, or 571¢/kg cwt (at a dressing percentage of 54%). Trade steers only managing a marginal increase with a 2¢ gain to 357¢/kg lwt, or 661¢/kg cwt – figure 2.

The week ahead

A forecast for some light rainfall for parts of Queensland and Victoria over the next week shouldn’t be enough to hamper transport so supply of cattle should continue to improve post Easter. Meanwhile, reduced beef cold storage levels for April in the US as they head into their “grilling season” should see the beef export prices supported in the coming weeks and will provide some encouragement to local processors on any price dips. These two factors set the stage for some price consolidation around the 650¢ level for the EYCI in the short term.

A forecast for some light rainfall for parts of Queensland and Victoria over the next week shouldn’t be enough to hamper transport so supply of cattle should continue to improve post Easter. Meanwhile, reduced beef cold storage levels for April in the US as they head into their “grilling season” should see the beef export prices supported in the coming weeks and will provide some encouragement to local processors on any price dips. These two factors set the stage for some price consolidation around the 650¢ level for the EYCI in the short term.

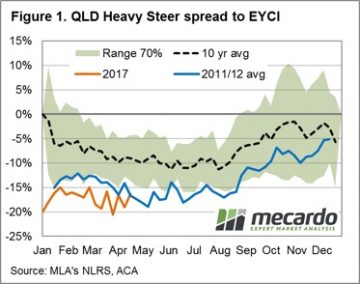

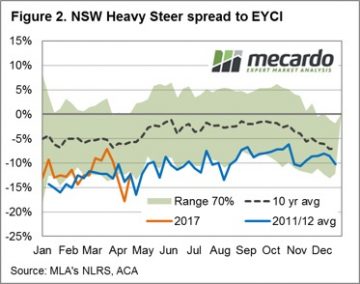

During a favourable season optimism runs high among restockers and opportunistic cattle traders supporting demand and prices for store/young cattle. The added buying competition between the three main purchasing groups (restockers, lot feeders and processors) will often see the Eastern Young Cattle Indicator (EYCI) outperform the price patterns for finished lines, as there is really only one buyer type for fat cattle – the processor. This piece will take a look at what can be expected for the spread pattern between heavy steers and the EYCI along the East coast for the next six months.

During a favourable season optimism runs high among restockers and opportunistic cattle traders supporting demand and prices for store/young cattle. The added buying competition between the three main purchasing groups (restockers, lot feeders and processors) will often see the Eastern Young Cattle Indicator (EYCI) outperform the price patterns for finished lines, as there is really only one buyer type for fat cattle – the processor. This piece will take a look at what can be expected for the spread pattern between heavy steers and the EYCI along the East coast for the next six months. Interestingly, so far for the 2017 season the spread pattern in all three states has been following a similar trajectory to the 2011/12 average pattern. In addition, each state’s spread pattern for this season is trending close to the lower end of the 70% banding, reflecting that the favourable conditions have supported young cattle prices more than the price for finished cattle. Perhaps somewhat unsurprisingly the state that was hit hardest by the most recent cattle turnoff, Queensland, is experiencing the widest spread between young and finished cattle as the requirement to rebuild the herd is likely to be most evident in that region.

Interestingly, so far for the 2017 season the spread pattern in all three states has been following a similar trajectory to the 2011/12 average pattern. In addition, each state’s spread pattern for this season is trending close to the lower end of the 70% banding, reflecting that the favourable conditions have supported young cattle prices more than the price for finished cattle. Perhaps somewhat unsurprisingly the state that was hit hardest by the most recent cattle turnoff, Queensland, is experiencing the widest spread between young and finished cattle as the requirement to rebuild the herd is likely to be most evident in that region. It is likely the spread patterns for each state will continue to trek along the lower end of the 70% band for much of the second half of the year. However, as the confidence level on longer term climate predictions for the 2018 season grows into the later stages of 2017 spreads may begin to return to more normal levels, particularly if the transition from a wetter to drier climate cycle becomes more evident.

It is likely the spread patterns for each state will continue to trek along the lower end of the 70% band for much of the second half of the year. However, as the confidence level on longer term climate predictions for the 2018 season grows into the later stages of 2017 spreads may begin to return to more normal levels, particularly if the transition from a wetter to drier climate cycle becomes more evident.

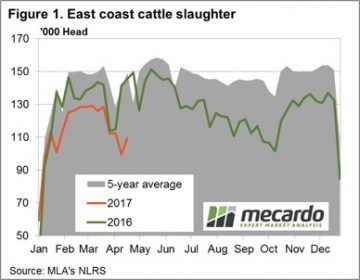

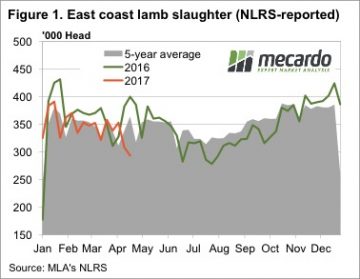

One of the most interesting numbers found this week was MLA’s weekly lamb slaughter for the week ending the 21st of April. Lamb slaughter came in at just 293,342 head, the lowest level since July last year. In the week ending the 21st Lamb slaughter fell 5%, and also sat 5% below the Easter levels of 2016.

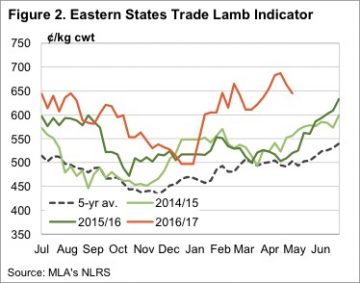

One of the most interesting numbers found this week was MLA’s weekly lamb slaughter for the week ending the 21st of April. Lamb slaughter came in at just 293,342 head, the lowest level since July last year. In the week ending the 21st Lamb slaughter fell 5%, and also sat 5% below the Easter levels of 2016. Not all lamb prices fell this week, Merino lambs gained 19¢ on the east coast, while light lambs were up 12¢. Neither quite managed to hit record highs, but are not far off at 611¢ and 673¢/kg cwt for Merino and Light lambs respectively.

Not all lamb prices fell this week, Merino lambs gained 19¢ on the east coast, while light lambs were up 12¢. Neither quite managed to hit record highs, but are not far off at 611¢ and 673¢/kg cwt for Merino and Light lambs respectively.