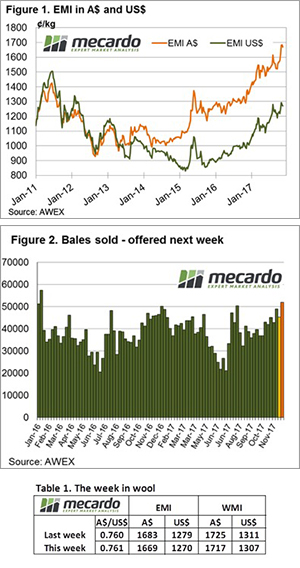

With the Christmas recess looming the market regained some upward pressure this week as exporters tried to lock in their requirements. Fine and medium fibre prices built up gradually across the sales, while most of the crossbred market moved into negative territory.

With the Christmas recess looming the market regained some upward pressure this week as exporters tried to lock in their requirements. Fine and medium fibre prices built up gradually across the sales, while most of the crossbred market moved into negative territory.

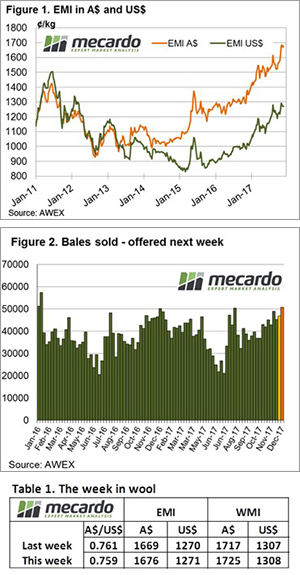

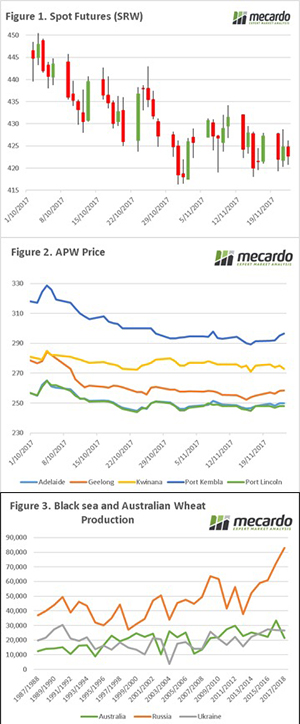

The Eastern Market Indicator (EMI) gained 7 cents to the week in Australian dollars, but when converted to US dollars, felt just a 1 cent increase. The story was similar in the West with the WMI lifting 8 cents.

Results from the superfine sale in Sydney this week were positive with a 36 cent gain for 16.5 micron fibres. This was the best result on the board with the other fine categories ranging from slight retractions to an average 20 cent gain. Medium fibre (19.5 to 22 micron) prices managed to correct themselves from the levels of the week prior. Rises of 15 to 25 cents were common at all three selling centres. Most microns and categories in the skirtings market received support in line with the gradual increase of the fleece market.

The crossbred market failed to bounce back like the Merino market this week. Prices continued to drop in the margin of 10 to 25 cents, particularly for lots that were poorly prepared. Locks and crutchings managed to attract some stronger prices in the oddments market and we saw washing lambs at extreme levels for the finer lots. The cardings indicators moved up slightly, with an average 3 cent increase across the three selling centres.

The week ahead

The bale offering over the last few weeks has been sizeable, and this is set to continue with 50,828 on offer next week. There has been discussion that the good market has driven a lot of growers to pull their shearing dates ahead of schedule this year. Given the offering we’ve seen over recent weeks, It looks as though many growers are running about a month earlier than on a typical year. If this is in fact the case, we expect that supply will drop out slightly in the new year.

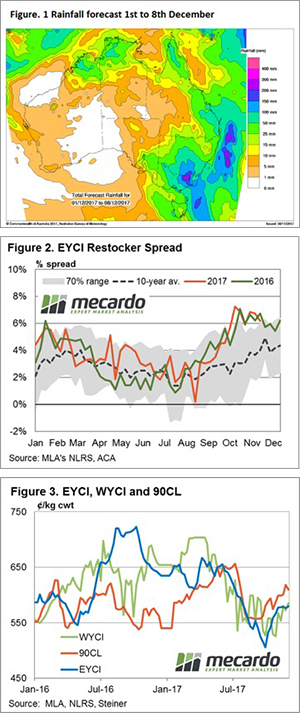

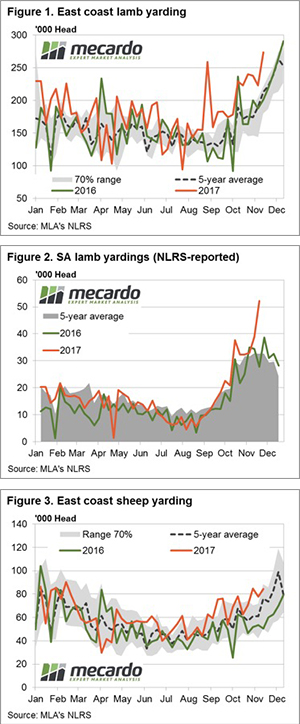

Forecast rain in the South-East corner of near biblical proportions for the week ahead keeps restocker interest high at the saleyard and young cattle prices across the country firm slightly in response.

Forecast rain in the South-East corner of near biblical proportions for the week ahead keeps restocker interest high at the saleyard and young cattle prices across the country firm slightly in response.

After weeks of a glowing market that seemed to keep on rising with record on record, the peak was finally reached and the market edged over the other side. Nearly all categories and microns across the country retracted on the week, however it wasn’t enough to cause too much concern.

After weeks of a glowing market that seemed to keep on rising with record on record, the peak was finally reached and the market edged over the other side. Nearly all categories and microns across the country retracted on the week, however it wasn’t enough to cause too much concern.

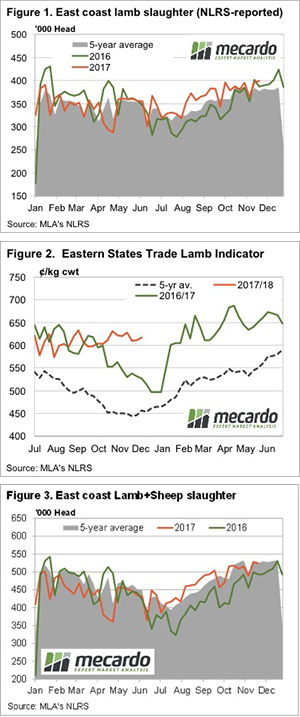

Meat and Livestock Australia (MLA) seem to have sorted out the differences with processors who were holding back data slaughter data. For the last couple of week’s slaughter data has confirmed what we thought, cattle supply has been tight.

Meat and Livestock Australia (MLA) seem to have sorted out the differences with processors who were holding back data slaughter data. For the last couple of week’s slaughter data has confirmed what we thought, cattle supply has been tight.

The South Australian Greens have extended the moratorium on GM in their state and over the past few weeks the mob at Mecardo have been investigating the claim made by the Greens that the GM ban, and their clean, environmentally sustainable image, provides a price premium benefit to SA producers. There has not been any sign of a premium on Canola, nor in mutton and lamb. This time we try to find it in cattle.

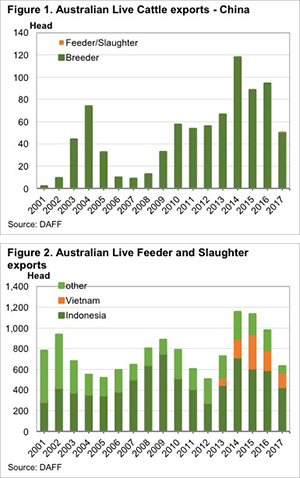

The South Australian Greens have extended the moratorium on GM in their state and over the past few weeks the mob at Mecardo have been investigating the claim made by the Greens that the GM ban, and their clean, environmentally sustainable image, provides a price premium benefit to SA producers. There has not been any sign of a premium on Canola, nor in mutton and lamb. This time we try to find it in cattle. According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not?

According the Australian Livestock Exporters Council (ALEC) it was agreed last week that China are going to cut the 10% tariff on live feeder and slaughter sheep and cattle imports by January 2019. Is this a big deal, or not?