In the last month, African Swine Fever (ASF) has extended its reach to the Philippines, Korea and most disturbingly to Australian borders at Timor Leste. Additionally, official Chinese acknowledgment has surfaced regarding the scale of the impact on the Chinese pork industry. After the seasonal winter lull, sheepmeat exports from Australia to China have surged again as consumers scramble to fill a growing protein gap.

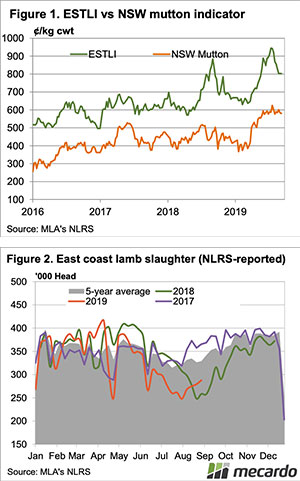

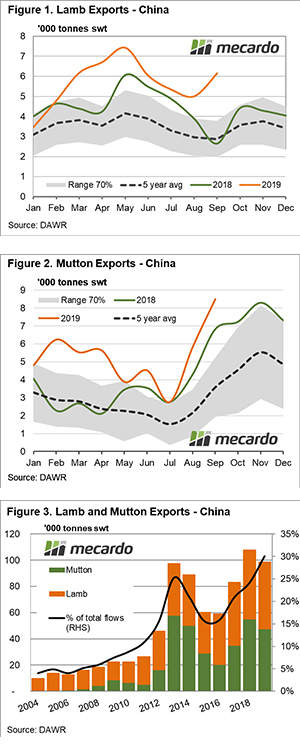

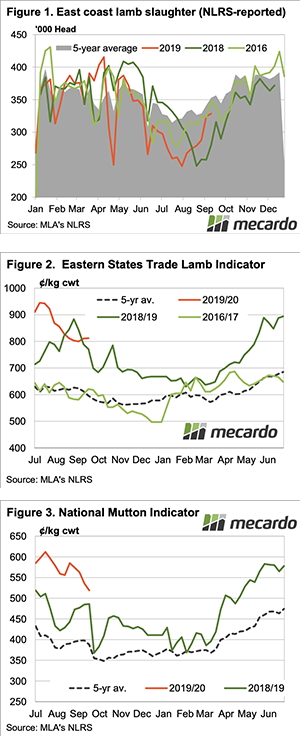

The first five months of 2019 saw significant growth in lamb consignments from Australia to China, peaking at 7,414 tonne swt in May. High prices for lamb and the winter lull in supply saw Chinese demand ease somewhat, although levels remained well above the normal seasonal range (Figure 1).

September saw a renewed surge in lamb export flows which took the monthly total to 6,141 tonnes swt. Year to date, the average monthly flow of lamb from Australia to China is trending 63% higher than the five-year average.

The jump in mutton flows from Australia to China were even more impressive over the September period, lifting 208% from the seasonal low posted for July (Figure 2). Year to date average monthly mutton exports are running 108% above the five-year average.

Combined, the flow of mutton and lamb to China this season is nearly at 100,000 tonne swt and represents 30% of our total export flows of sheepmeat this season (Figure 3). However, if we remain on current trajectories could see it reach to around 145,000 – 150,000 tonnes by the end of 2019.

What does it mean?

China has recently acknowledged that ASF has impacted their breeding herd with numbers down by around 35% this year. If their current infection and cull rate remains in place, they could see up to 200 million head of pigs taken out of their production system by the end of 2019. This would equate to a 40% loss in annual production, creating a protein deficit of up to 20 million tonne cwt.

Just for perspective, Australia’s annual production of beef is 2 million tonnes and our combined sheepmeat production is around 0.7 million tonnes, on a carcass weight basis. With no vaccine, ASF isn’t going to go away in a hurry from the Asian region. The disease will impact the global demand for protein for years to come.

For more information on ASF and the impact on the Australian agricultural environment contact us at ask@mecardo.com.au as we have detailed information available across multiple commodities and market sectors.

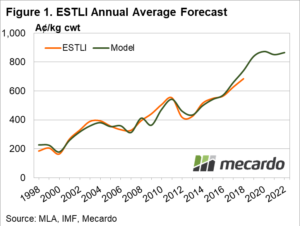

Predictor inputs to the lamb and mutton pricing models include an annual average A$ forecast, annual slaughter volumes (as outlined by MLA sheep industry projections), an annual climate factor, per capita, GDP levels of key importing nations and sheepmeat export volumes to key destinations.

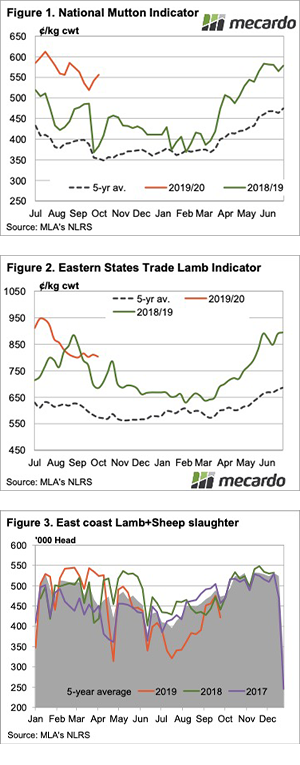

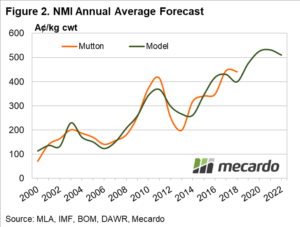

Predictor inputs to the lamb and mutton pricing models include an annual average A$ forecast, annual slaughter volumes (as outlined by MLA sheep industry projections), an annual climate factor, per capita, GDP levels of key importing nations and sheepmeat export volumes to key destinations. National Mutton Indicator modelling shows similarly strong predictions for the next four years with the forecast tool indicating an annual average NMI remaining above 500¢ for the 2020 to 2022 period (Figure 2). The 2020 season is expected to see an annual NMI of 525¢, with a potential range of 405¢ to 640¢ from the seasonal trough to peak during the year. The NMI for 2021 is expected to average 531¢, easing to 510¢ for the 2022 season.

National Mutton Indicator modelling shows similarly strong predictions for the next four years with the forecast tool indicating an annual average NMI remaining above 500¢ for the 2020 to 2022 period (Figure 2). The 2020 season is expected to see an annual NMI of 525¢, with a potential range of 405¢ to 640¢ from the seasonal trough to peak during the year. The NMI for 2021 is expected to average 531¢, easing to 510¢ for the 2022 season. A scenario of dramatically increased demand for sheepmeat from China would see forecast price levels elevated further.

A scenario of dramatically increased demand for sheepmeat from China would see forecast price levels elevated further.