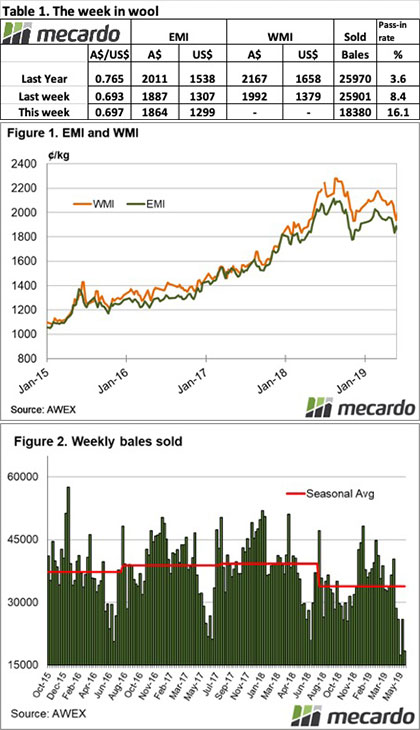

While the market again suffered a significant fall, the AWI commentary on the market noted that almost all of the damage occurred on day one of selling, with a more measured response from exporters on Thursday.

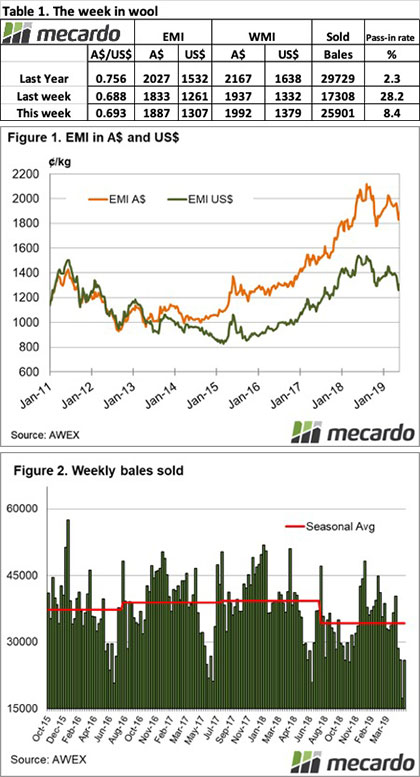

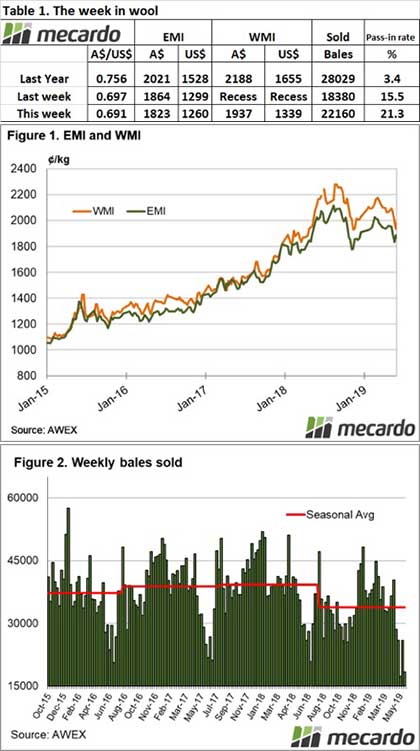

Since the peak of March, in four months the EMI has lost 261 cents, or 14%; while in US$ terms it has fallen 233 cents or 16%. Bales sold is also down, 84,500 or 15% less than over the corresponding period.

The Eastern Market Indicator (EMI) fell back a further 57 cents this week on top of the 41 cents fall of last week and closed at 1,766 cents. The Au$ was also weaker slipping below US $0.69 mark and as a result, the EMI in US$ terms fell 42 cents, ending the week at 1,218 US cents (Table 1).

The AWI market commentator lists exporter finance issues, trade & tarrif wars and Brexit as all factors impacting negatively on the market over the past four months.

On the positive side, the EMI has not been as low in US$ terms since October 2017, so for the processors who have stood back from the market the price now should be more attractive.

Supply is well back, both in seasonal and year-on year comparisons causing exporters to run down inventories; so along with the fact that over the next 2 months Australia is the only market with any volume, if there is any move to replace stocks we will see stronger demand. These are all factors leading to the suggestion that we may see the market find support at these levels.

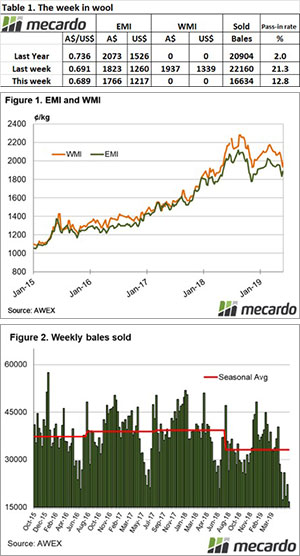

Only 19,072 bales were offered at Sydney & Melbourne, 9,068 fewer than last week with Fremantle again not participating. The pass in rate across the selling centres was 12.8% for the week, Although well down on last week’s 21.3% the low offering meant that 16,634 bales were cleared to the trade, 4,270 fewer than the corresponding week last year.

We looked back to 2015 and could not find a lower week of wool bale clearance, this could well be the lowest for 50 years or more! In the auction weeks since the winter recess, 1,390,315 bales have been cleared to the trade, 278,830 fewer than the same period last year.

The dollar value for the week was $30.38 million, for a combined value so far this season of $3.150 billion.

The week ahead

Next week a combined offering of just over 30,800 bales is rostered across all selling centres. For the following weeks 35,200 and 35,500 bales are currently forecast.

It cannot be ignored that the wool market is weak. If we compare when the market was at 1750 cents in early 2018, the outlook is far less optimistic despite lower supply. Back then the thought was “the market can only go up”. 16 months later after running through 2,000 cents we are back where we started at 1766 cents, but with a far less optimistic outlook.

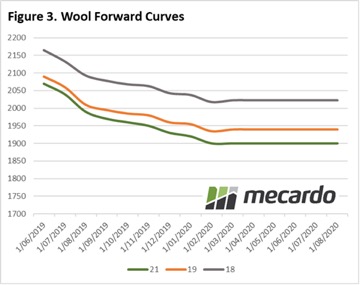

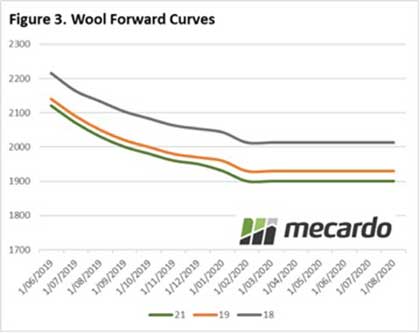

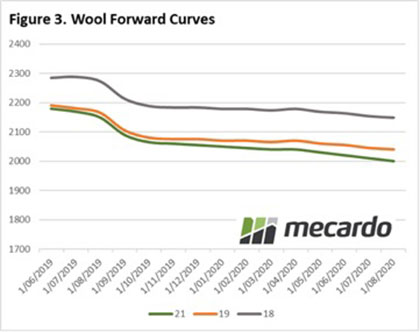

Another solid week in the forwards market, with 21 micron being the main MPG dealt. One trade was dealt for 19 micron wool for August and agreed at 2,180¢. Four trades were dealt for 21 micron wool. One of those was for September at 2,080¢ and one for October at 2,050¢. Two trades were agreed for November at 2,050¢ and 2,075¢ respectively. Two trades were dealt for 28 micron wool and were agreed at 1,100¢ and 1,130¢ for August.

Another solid week in the forwards market, with 21 micron being the main MPG dealt. One trade was dealt for 19 micron wool for August and agreed at 2,180¢. Four trades were dealt for 21 micron wool. One of those was for September at 2,080¢ and one for October at 2,050¢. Two trades were agreed for November at 2,050¢ and 2,075¢ respectively. Two trades were dealt for 28 micron wool and were agreed at 1,100¢ and 1,130¢ for August.