It is now becoming clearer how the COVID-19 virus is impacting on the wool market. Bale clearance at auction is down with mills either not operating or at reduced capacity, finance of the wool pipeline more difficult, and retail demand uncertain or in lockdown impacting on garment orders.

There is an air of determination from the market, but an underlying nervousness pervades.

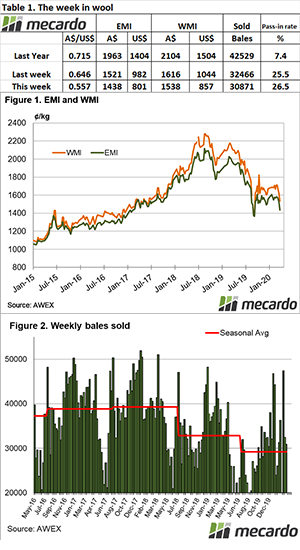

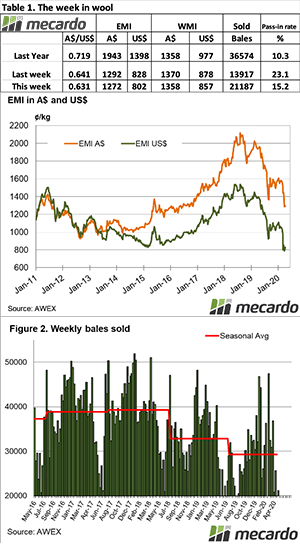

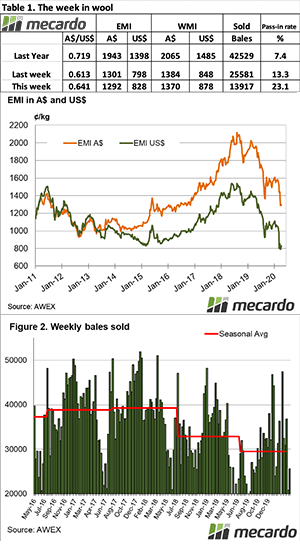

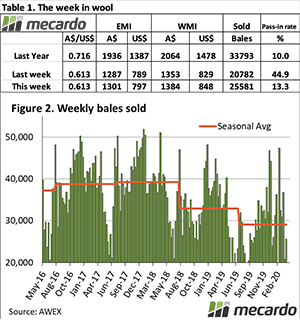

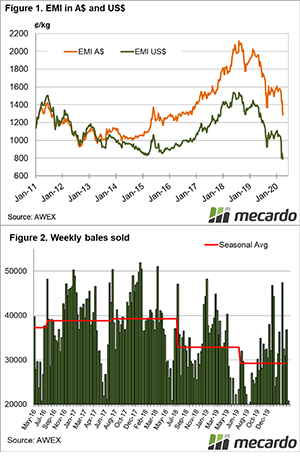

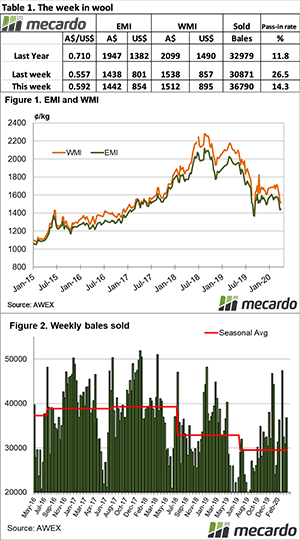

The market continued to contract this week with the Eastern Market Indicator (EMI) losing 20 cents for the week to close at 1,272 cents. The Australian dollar was weaker easing 1 cent to US$0.631, which pulled the EMI in US$ terms down 26 cents to 802 cents. The Western Market Indicator also came back 12 cents to close at 1,358 cents.

Turnover this week was $28.76 million at $1,357 per bale, taking the year to date value to $1,756 million.

The pass-in rate was lower at 15.2% nationally with 21,187 bales cleared to the trade. 17.5% of the original offering was withdrawn prior to sale easing the pressure on the market. Of note Sydney offered 4,696 bales selling just 4,067. This was the lowest Sydney offering since AWEX records began in1997/98 season. Season to date there have been on average 6,340 bales fewer sold per selling week compared to last season.

Coming in to the CV-19 crisis, retail sales of clothing in the major wool consuming countries were mixed. As reported by NCWSBA, China consumption was the first to fall, down a massive 33% in January compared to year earlier figures. Apparelware is experiencing a worrying slowdown, with both online and offline sales for businesses the world over taking a major hit.

As consumers hold back on their spending, clothing brands of all shapes and sizes are forced to scale back production, and reimagine how they position themselves.

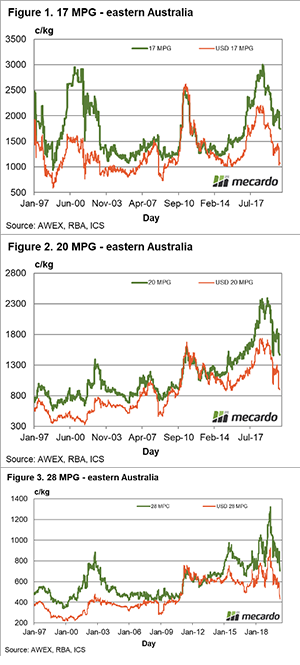

AWEX reported all Merino types were cheaper with the exception of the finest MPG’s and wool of better style and measurement which posted modest gains. The bulk of the Crossbred types were cheaper as were Cardings.

The week ahead

Next week a national total of 25,554 bales will be offered with Fremantle & Melbourne selling on Tuesday & Wednesday, while just 5,406 bales will be offered in Sydney on Wednesday only.

After trending lower for 18 months, wool prices would normally start to look for reasons to stabilise. That appeared to be the case in late 2019, but the occurrence of a pandemic (COVID-19) has added a further leg to the existing cyclical downturn in wool prices. This article takes a look at the latest step down in price.

After trending lower for 18 months, wool prices would normally start to look for reasons to stabilise. That appeared to be the case in late 2019, but the occurrence of a pandemic (COVID-19) has added a further leg to the existing cyclical downturn in wool prices. This article takes a look at the latest step down in price.

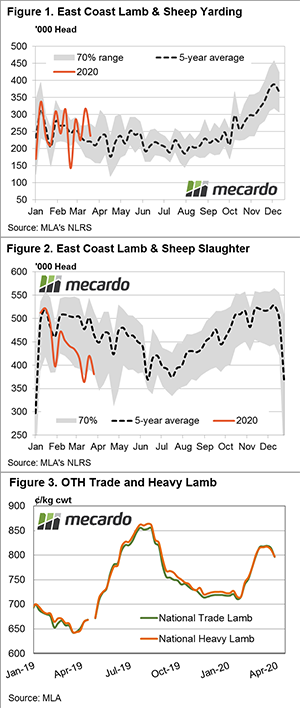

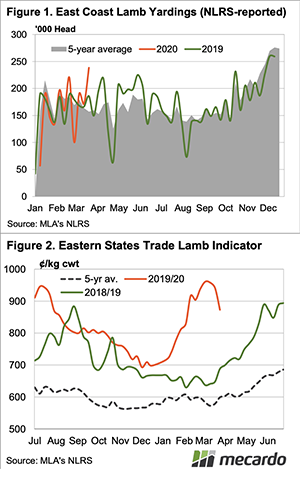

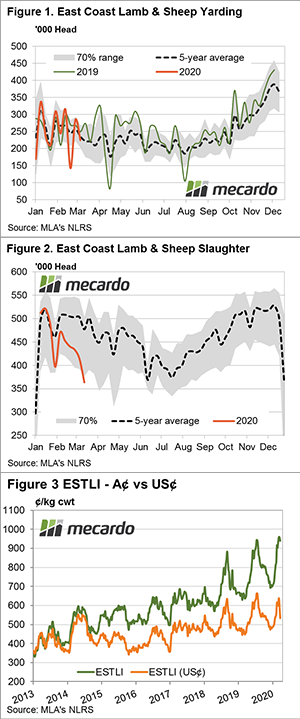

In an environment of limited price data and scant access to sheep/lamb indicators we are used to there is still the ability to see what is going on with throughput volume and slaughter. Producers respond to lower prices with a reduced offering at sale yards and meat works reluctant to increase their appetite as supply chains slow and export markets pause for Covid19.

In an environment of limited price data and scant access to sheep/lamb indicators we are used to there is still the ability to see what is going on with throughput volume and slaughter. Producers respond to lower prices with a reduced offering at sale yards and meat works reluctant to increase their appetite as supply chains slow and export markets pause for Covid19.

supermarkets are keen to restock after a run on red meat. With the A$ collapse and concern over a Covid19 economic growth hit the uncertainty has filtered through to sheep and lamb prices.

supermarkets are keen to restock after a run on red meat. With the A$ collapse and concern over a Covid19 economic growth hit the uncertainty has filtered through to sheep and lamb prices.