This week the wool market opened strongly in the three selling centres, posting gains across all MPG’s of up to 100 cents. Again, the medium merino types found the strongest price increases, although any “Good style” wools with high N/Ktex in the fine types were also highly sought.

By the week’s end 18 MPG in Melbourne had improved 40 cents, 20 MPG 100 cents, and the Cardings indicator were again above 1,000 cents across all centres. A strong result across the board.

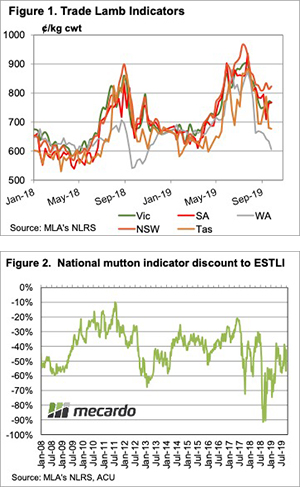

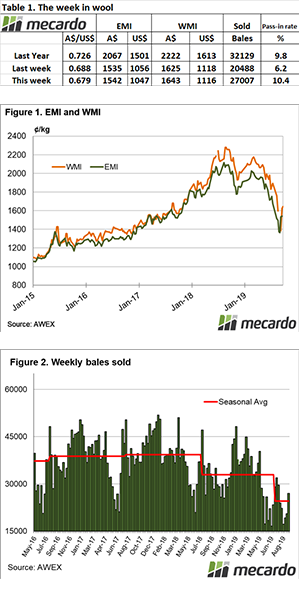

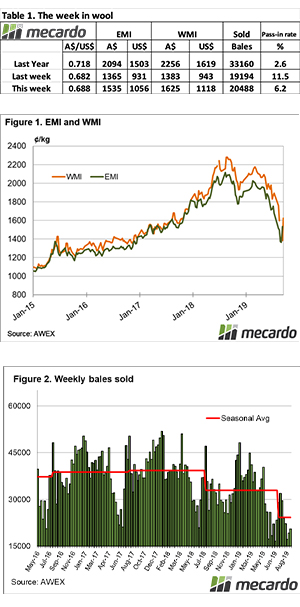

The Eastern Market Indicator (EMI) lifted 67 cents or 4.2% for the week, to finish at 1,542 cents. The Au$ fell slightly to US $0.676. This saw the EMI in US$ also lift by 40 cents to end the week at 1,087 cents.

Western Australia performed strongly on the opening day posting some significant gains which continued in the early part of Thursday. Of concern though, was that AWEX reported that the “fleece market noticeably softened” toward the end of the week. This resulted in falls of 30 – 70 cents on the day, however over the week the Western Market Indicator rose by 59 cents to close at 1,702 cents.

Sellers reacted to the improved market with the National Pass-in (PI) rate for the week 7.6%. Of interest is that the PI rates plummeted this week to 3.0 & 4.0% in the North & South respectively, recording the lowest rates for the past 3 months. It was a different story in W.A., for the week almost 20% was passed, and on Thursday in the softer market, this figure touched 30%.

When looking back we note that while the EMI is currently at 1600, in May the EMI was 1900 cents with a PI rate at 20%. It seems seller expectation has moderated.

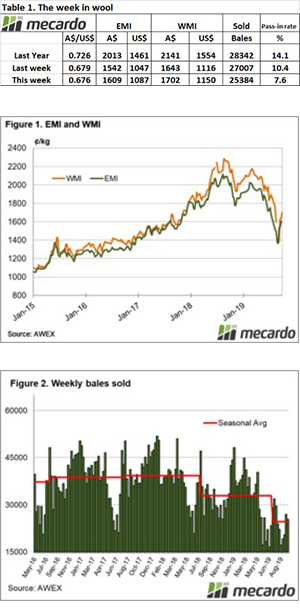

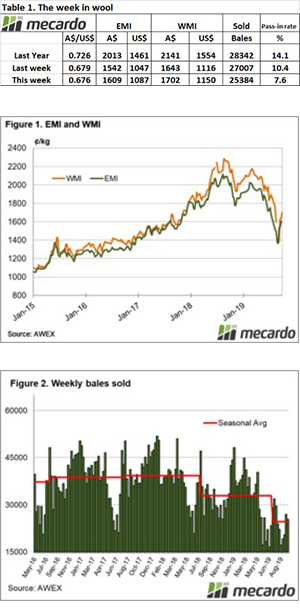

27,458 bales were offered to sale with 25,384 bales cleared to the trade (Figure 2). There have been 102,483 fewer bales sold this season compared to the same period last year. This is an average weekly gap of 10,248 bales.

The dollar value for the week was $47.35 million, for a combined value so far this season of $424.93 million.

The week ahead

Next week a larger offering of 40,999 bales are rostered, falling back to around 30,000 in subsequent weeks.

The market appeared to have shaken off its doldrums retracing 64% of its August fall. We have concern though about the weaker market in Fremantle at the end of the week. The increased offering and soft finish this week will be causing stress to buyer & sellers regarding next weeks market.