It concerns me that we are starting to get accustomed to the “roller-coaster” ride that has become the wool market. The wild fluctuations are causing sellers a headache, deciding whether to sell, pass lots in, withdraw or wait.

We can only guess what this is doing to the exporters and processors, as they manage supply requirements alongside the unpredictable price movements of recent months. It is hard to imagine anyone is pleased with the recent volatility and it must be damaging the wool markets reputation internationally.

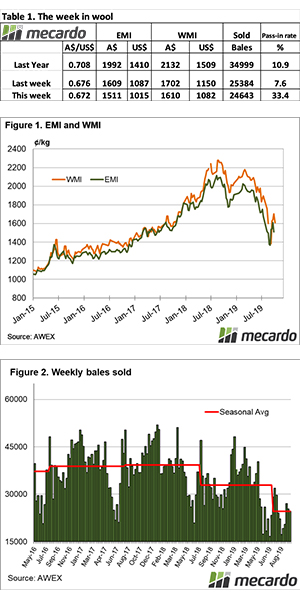

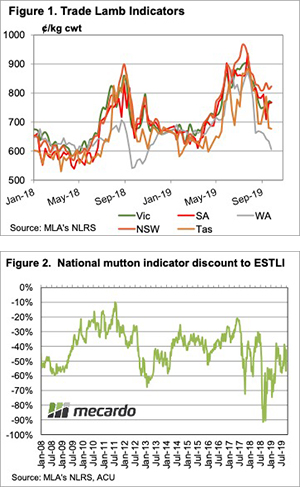

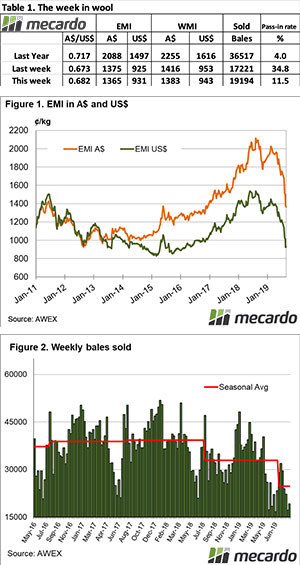

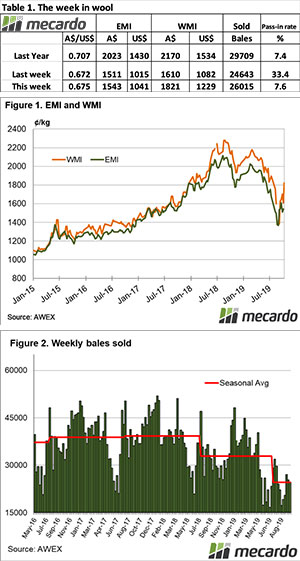

The Eastern Market Indicator (EMI) rose 32 cents or 2.1% (after losing 97 cents or 6% last week), to close at 1543 cents. The Au$ also rose to US $0.675. This saw the EMI in US$ also improve 26 cents to end the week at 1041 cents.

The Fremantle sales also fared well, with the Western Market Indicator recovering 43 cents of the 92 cents loss of last week to close at 1,653 cents. Again a small offering selling just 6,245 bales with a PI rate of 13.1%, modest compared to last weeks 40.8%.

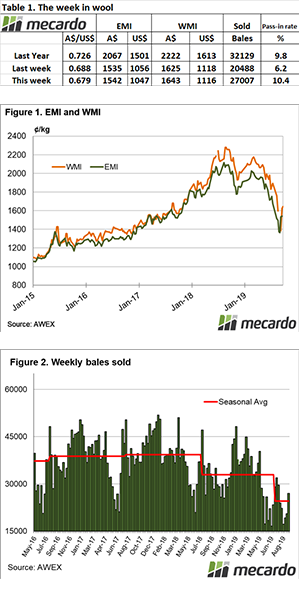

Sellers reacted in what has become their normal response by “selling” into the rising market. The National Pass-in (PI) rate was 7.6%, compared to 33.4% of last week. AWEX reported that in response to last weeks big falls, growers withdrew large volumes prior to sale. For the week 4,620 bales were withdrawn.

A decreased offering of 28,149 bales came forward, with 26,015 bales cleared to the trade (Figure 2). There have been 116,533 fewer bales sold this season compared to the same period last year. This is an average weekly gap of 9711 bales.

As reported this week by Andrew Woods on Mecardo (view here), fine Merino prices have been under pressure from increased supply during the past 12-18 months, which has resulted in premiums shrinking to very low levels. As the fibre diameter approaches year earlier levels and then starts to increase, the supply of fine wool will steady and then begin to fall. This will reduce downward pressure on fine wool premiums. The reverse process, to a certain extent, will apply to broad Merino wool.

The dollar value for the week was $45.83 million, for a combined value so far this season of $512.71 million, and a bale average value $1,730.

While last week the Cardings indicators held against the tide, this week they were cheaper across the board, averaging a fall of 20 cents. The news from the Crossbreds types was that the 26-28 MPG’s improved, except for poorly prepared clips which were cheaper or were passed-in.

Next week an offering of 40,056 bales are rostered.

To continue to predict the market movements in this climate is a bit like following the formline of “The Wallabies”, you don’t know what you will get until the day. The long decline in wool export volumes should begin to play on processor inventories (assuming sales are continuing), so we will go for the market to continue on an improving trend for next week.