A rocket to the moon, or even beyond the Kuiper belt?

Well this is good news, wheat is on a journey to the moon, and at this rate beyond the planets. The downtrend of the past week has been reversed in dramatic fashion, is this a sign of things to come?

Well this is good news, wheat is on a journey to the moon, and at this rate beyond the planets. The downtrend of the past week has been reversed in dramatic fashion, is this a sign of things to come?

It’s the middle of the weather market, and as we have mentioned for months this is where opportunities can arise when the trade gets jittery. Overnight we saw futures close up across the board, with US futures up 5%, and Matif following up 2%.

The market has rallied on the back of continuing bullish data being release to the market, with the US drought monitor showing large parts of the Great Plains being in a rainfall deficit, and a corresponding drop in the crop potential. In Canada, canola planting according to Statscan have exceeded wheat, as a result of more attractive gross margins on the oilseed.

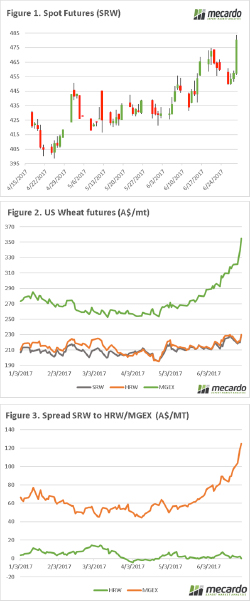

In figure 1, we can see the rise in nearby Chicago SRW futures, the rise was so high that I had to change my scale this morning to fit it on the chart. The spot contract has not been at this level since mid-June last year, before it fell as production became sure. As we go through the next month, how will the weather impact on the crop?

The rise in SRW has been fantastic, and most welcome to farmers around the world. However, it is dwarfed by the Minneapolis spring wheat contract which has been a stratospheric rise the like of which has been seen for a long time. In figure 2, we can see the SRW, HRW & Mgex contract converted into A$/mt since the start of the year.

The spread between SRW and HRW/MGEX is shown in figure 3, and it currently sits A$124 above spot SRW. This is due to the expected shortage of hi-pro wheat, will this rise be sustainable and make it past the moon, and beyond the Kuiper belt or will it crash back down to earth?

Next Week

The USDA will release their quarterly grain stock reports, will this show a downturn in US stocks or has less been used than expected. This report has traditionally had the capacity to move the markets markedly.

All strategies must evolve to take into account the potential average-low production environment in the coming season. There is no point removing price risk in order to replace it with production risk.