Ameri-can and Mexi-can’t

It’s now nearly a week since Trump was sworn in,

and he has been busy signing executive orders. The

market is tentatively watching Trumps actions,

especially when it comes to corn.

One of the first acts which Trump performed was a

freeze on the activities of the Environmental

Protection Agency (EPA). This has caused a high

degree of consternation by climate change proponents

throughout the world. One of the key environmental

policies introduced by the EPA under the Obama

administration was the renewable fuel

standard/biofuel mandate. This required petroleum

producers to blend at least 10% bioethanol with fossil

oil, and there were plans to increase the blend.

This is great news for corn producers in the US, as it

created a relatively inelastic demand for corn to

maintain the blending ratio. It is speculated that

Trump may at the least curtail the biofuel mandate,

which would have a detrimental impact on demand

and therefore price.

In addition, Trump has continued his calls for a wall

between Mexico and the US which unsurprisingly is

increasing tensions between the two nations. The US

and Mexico are strong trade partners when it comes to

corn, with nearly all corn imports in Mexico originating

in the US.

Any issue with trade between the two countries would be

likely to impact corn (and linked feeds), as Mexico is the

2nd largest importer of corn in the world. In recent months,

Mexican buying power has already been eroded, with the

value of the US$ rising against the Peso, since the day of

the election (figure 1).

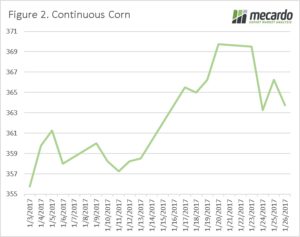

The biofuel mandate and the deteriorating Mexico-US

relations have impacted the corn market (figure 2) in recent

days, a deteriorating corn price will flow through to other feed

grains such as sorghum and barley.

Trump’s executive orders could be extremely negative to US

corn farmers. It is yet to be seen how far the policies enacted

by the president will marry up with his election speeches, but so

far, he has held up to his word. I would however expect that the

strong farm lobby in the US, where has a high degree of support

will in time make his moves more cautious.

The Week Ahead

Politics will continue to play a part as the market unwinds

Trump’s intentions, however eyes will start to move towards

the progress of the northern hemisphere crop.

It is still too early to form a strong view on the global crop,

but to raise prices substantially we do require a supply shock.