Call it the Kekovich effect

It’s been an extraordinary week in lamb markets. Lamb markets have

reached high which are usually seen in winter in the second week of

January, a time when supplies are usually good. When prices rise it’s

due to falling supply or rising demand, we suspect it’s a combination,

helped by the ‘Kekovich Effect’.

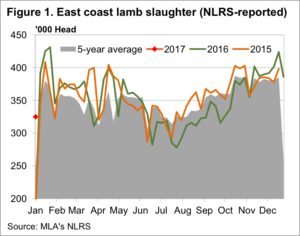

Figure 1 shows that in the second and third week of January in the last

two years, and on average over the last five years, we have seen the

largest slaughter of the first half of the year. Normally heavy slaughter

equates to lower prices.

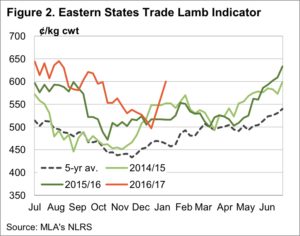

However, figure 2 shows that despite high slaughter rates, prices in

January have been steady or higher. How do we explain higher supply

and steady or higher price? Call it the ‘Kekovich Effect’, driven by Meat

and Livestock Australia’s (MLA) Australia Day lamb marketing campaign.

Demand for lamb obviously increases before Australia Day, lamb processors need more lambs, and supply is usually compliant in early January.

This year it seems some processors have been caught short. This week’s

Wednesday and Thursday sales gave a taste of what processors are willing to pay, with many lambs selling for well over 600¢, and the Eastern

States Trade Lamb Indicator finishing at 599¢/kg cwt.

Light lambs are doing even better, with restockers paying 661¢, and

light lambs selling for 607¢ on the east coast.

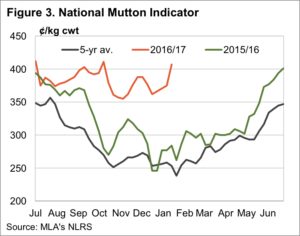

Mutton has also joined the party, with the National Mutton Indicator (figure 3)

rising 32¢ to hit a three month high of 407¢/kg cwt. Mutton demand is not

likely to have increased like lamb, but rising prices suggest small stock

processors can’t find enough lamb, and are turning to mutton.

The Week Ahead

As outlined earlier in the week, the heavy supply of December is

coming home to roost, with few shorn lambs ready, and sucker

lamb supply basically done. The Kekovich Effect has at least a

week to run, which suggests lamb prices might stay strong for

another week or so.

After that, don’t be surprised to see lamb prices ease back, as supply

improves, and demand weakens post the Australia Day demand peak.