Cashing in the flock

The talk of the town at the Wycheproof store sheep sale last week centred on the line of first cross ewes making $322/head, and merino ewes reaching $260/head. While many sheep producers are enjoying a good season, some might be thinking it’s a good time to cash in a portion of the flock, go on holidays and buy back in the spring. Today we look at how this might play out.

There is plenty of talk about store sheep being expensive, but are they overpriced? It depends on your definition, but one way to look at it is to look at whether ewes bought now are going to be worth more in six months’ time, or worth less.

There is plenty of talk about store sheep being expensive, but are they overpriced? It depends on your definition, but one way to look at it is to look at whether ewes bought now are going to be worth more in six months’ time, or worth less.

We have to put a few assumptions in place to come up with an answer. We’re assuming ewes will not be shorn between now and November, and the first cross ewes will produce 130% lambs, and Merinos 90%. All lambs will be terminals. Lambs will be sold as trade suckers in November, and ewes will be valued as stores. We use an interest rate of 4%.

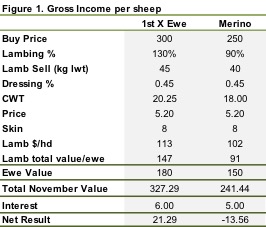

Table 1 shows the result of the trade, if lambs and ewes are priced at similar levels to November last year. If buying first cross ewes now for $300/head the grower receive $147 in lamb value, and have a ewe worth $180 in November. This gives a net gain of $21.29/head after interest is taken into account.

For Merinos the net result has the buyer of Merino ewes at $250/head running at a loss, with the net result being negative $13.56. Wool growth is hard to account for, but we have tried to build this into price of the ewe in November. Those buying Merino scanned in lamb ewes are banking on a good wool cheque to bolster profits on the trade.

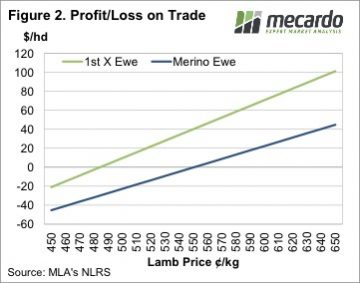

Obviously higher lamb prices will make the result look better for the buyer of ewes, while lower prices will make it look worse. Figure 2 shows a rough estimate of the profit on the trade at different lamb price levels.

Key points:

- Scanned in lamb ewes are making very good money at store sales.

- There appears to be some money in buying first cross ewes, while merinos are marginal.

- It’s hard to see sellers of SIL ewes losing out at current prices, unless the sheep and lamb market maintains very strong values into the spring.

What does this mean?

For those looking to buy or sell scanned in lamb sheep the question is whether the cost of running the sheep through to November is higher than the net result. For merinos all businesses would incur more than in costs in lambing down and marking lambs. For the first cross ewes cost or running may not outweigh the profit on the trade so they might be a better purchase.

For those looking to buy or sell scanned in lamb sheep the question is whether the cost of running the sheep through to November is higher than the net result. For merinos all businesses would incur more than in costs in lambing down and marking lambs. For the first cross ewes cost or running may not outweigh the profit on the trade so they might be a better purchase.

We haven’t accounted for the possible alternative uses of grass in this analysis, with agistment an option, which could pay a similar return to the first cross ewe. However, without owning stock, growers have no access to price upside. Given the current state of the sheep market, we suspect there is more downside than upside, so this might not be a problem. As such those looking for less work this winter can sell some sheep without too much fear of losing out.