Earlier in the week we took a look at beef export flows out of New Zealand, and the impact increased Chinese demand was having on markets. Chinese demand for lamb and mutton has also been on the rise, and it’s an opportune time to look at how New Zealand is faring on this front.

New Zealand is Australia’s only real competitor in lamb export markets, and as such it’s worth checking in on how their exports are tracking.

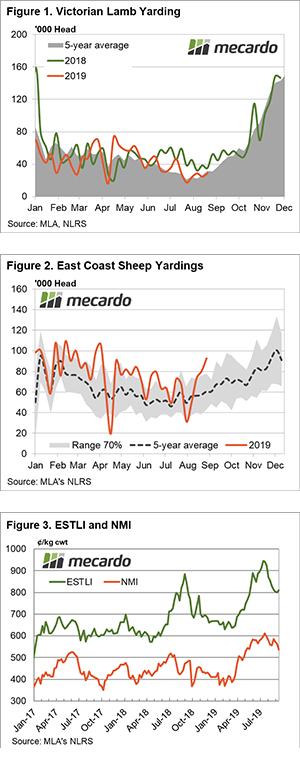

China has traditionally been a large market for New Zealand. For the year to date New Zealand has exported more than twice the amount of lamb to China than Australia has. Over the last five years New Zealand has exported 64% more lamb to China than Australia. Needless to say China is a major market for New Zealand.

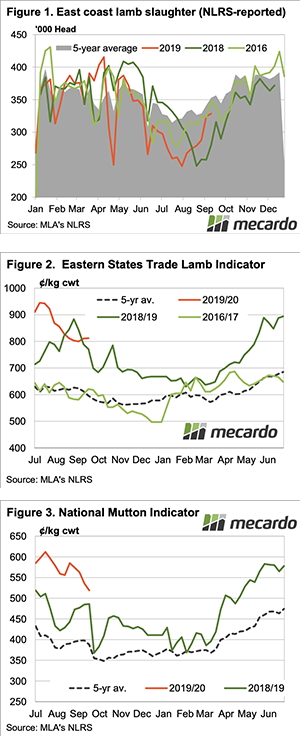

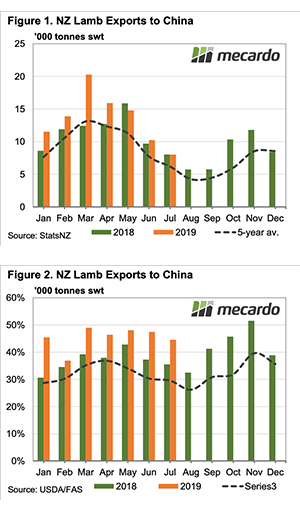

Despite being historically strong, New Zealand’s exports to China have been even stronger this year. Figure 1 shows that every month except May have seen larger NZ lamb exports to China, and this has seen the year to July exports up 19% on last year, and 37.5% on the five year average.

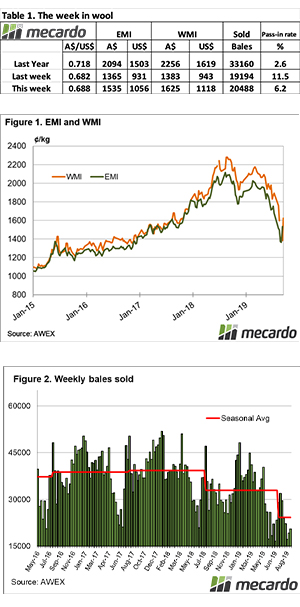

The increases in exports to China have not been due to stronger production. Figure 2 shows China’s share of New Zealand’s beef exports has grown this year. For the year to date 45% of New Zealand’s lamb exports have gone to China. China’s share was well up on 37% in 2018 and 32% average over five years.

Figure 1 shows there is plenty of seasonality in New Zealand’s exports to China, and while this is a function of production seasonality, China’s share of exports does decline in winter. A smaller share for China when production dips is likely due to European markets having more money.

China’s increased volume and share or New Zealand’s lamb exports has come largely at the expense of the United Kingdom. The UK is New Zealand’s second largest export market, yet its share lamb exports has fallen from 16% in the year to July 2018 to 12% in 2019. The US is the third largest market to NZ lamb, and managed to maintain its share at 7%.

What does it mean/next week?:

Increasing demand for lamb from China has been impacting our friends over the ditch as well. We can see declining production and exports from New Zealand in June and July obviously helped push our prices higher.

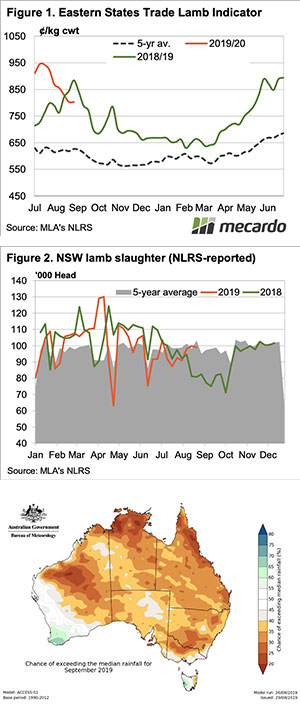

Moving forward China will start getting more lamb out of New Zealand in November and December, and this will help keep a lid on price rises here. However, the increasing share of lamb going to China means other markets might have to come to Australia to find their fill.