ESTLI holds firm despite strong throughput and currency

The Eastern States Trade Lamb Indicator (ESTLI)

held onto the strong gains since the start of the

year remaining above 600¢/kg cwt this week

in the face of solid lamb throughput figures,

particularly from NSW, and a resurgent A$ –

boosted by a Trump impacted weaker US$.

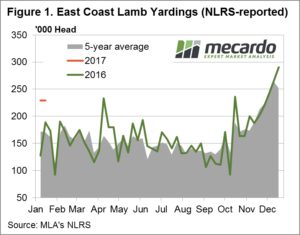

Figure 1 shows the east coast lamb yarding

figures for this week opening the year at

229,495 head, some 21.6% above the yarding

figures for this time last season and 34.7%

higher than the five-year average. Overall east

coast lamb yardings given a boost from NSW

throughput, which came in 26.4% above figures

recorded for this week in 2016 and 58.9% higher

than the five-year average for this time of year.

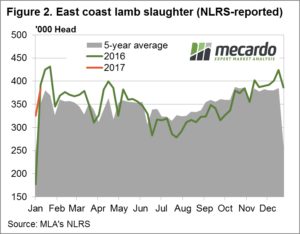

After a stronger start to the season slaughter figures

have returned to levels consistent with the 2016

pattern – figure 2. East coast lamb slaughter for the

week ending 13th January reported at 382,865 head,

a mere 2.3% below the slaughter figures for the same

week in 2016 and 8.9% above the five-year average

for this time in the season.

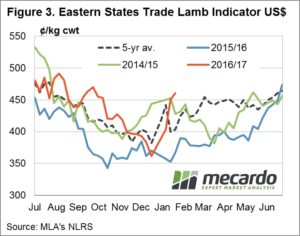

The ESTLI closing yesterday at 609¢/kg cwt, a

10¢ gain on last week. Not as impressive as the

previous week’s rally but a gain nevertheless.

Combined with an A$ 5% higher than where is

finished 2016 this places the ESTLI in US$

terms the highest it has been since September

2016 – figure 3. Despite the recent A$ strength

the currency currently trading at 75.5US¢ is still

below the two-decade average of 76.25US¢.

The Week Ahead

The A$ recovery over the last month has been on

the back of broad US$ weakness with financial

market nervousness setting in as we draw closer

to a President Trump inauguration. Expect regular

currency volatility as the new leader settles in and

his unpredictable style of communication via Twitter

running of the country continues to unnerve the

market. Any significant impact on export demand

for Australian sheep and lamb product unlikely

unless a prolonged period of US$ weakness pushes

the A$ above 85-90US¢.