Lamb markets open hot, metaphorically and literally

For the first week in January there was certainly some big news this week. On Wednesday the biggest lamb market in the country at the moment opened even higher than the very strong close. And on Wednesday night one of the country’s largest lamb processors had a fire.

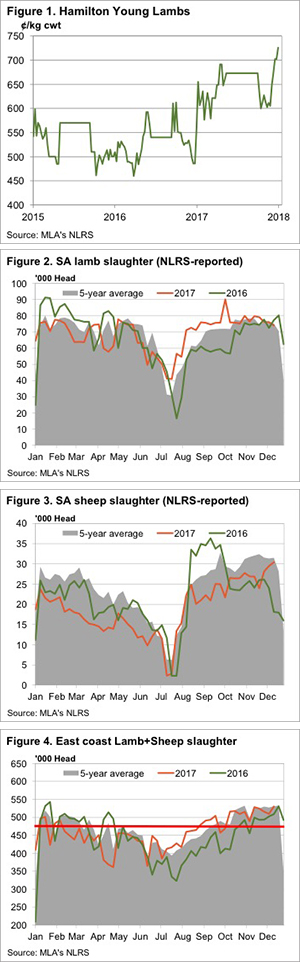

At the Hamilton Lamb sale on Wednesday lamb prices gained a bit more ground,  after having rallied strongly in December. This week’s rise was in the order of 20¢ for ‘young lambs’ (figure 1). More shorn lambs will start to hit the yards over the coming weeks, but young lambs are still the majority of this market.

after having rallied strongly in December. This week’s rise was in the order of 20¢ for ‘young lambs’ (figure 1). More shorn lambs will start to hit the yards over the coming weeks, but young lambs are still the majority of this market.

This early sale might have producers deciding to sell whatever was left, but the fire at Thomas Foods International (TFI) on Wednesday has thrown a massive black swan into the works.

In an article in ‘The Land’ back in November TFI were quoted as killing 55,000 sheep and lamb at Murray Bridge per week. Figures 2 and 3 show weekly slaughter for SA, with the Murray Bridge plant accounting for 50-55% of SA capacity.

On a national scale the Murray Bridge plant kills 10-12% of sheep and lambs. To take this capacity out of the system overnight is guaranteed to have some impact on demand.

The good news is that there might just be enough capacity at other plants to take up TFI’s sheep and lambs. Figure 4 shows that the peak weekly sheep and lamb slaughter for the last 12 months was in December, at 530,000 head. If we assume this is full capacity, and deduct 55,000, this gives us a new number of 475,000 head, shown by the red line.

For the first half of the year at least, if supply runs in a similar fashion to last year, the market shouldn’t be constrained by slaughter capacity.

The week ahead

Uncertainty is not good for markets, and this might lead to a short term slump. We do know, however, that domestic and export lamb and mutton demand isn’t going to go away, the main risk is a processing bottleneck. The best example of this was the 2013-15 drought which saw more cattle on the market than could be killed, or carried, and very weak prices.

There is probably enough sheep and lamb slaughter capacity, along with carrying capacity on farm, to avoid a crash in sheep and lamb markets in the first half of the year at least. Over the coming weeks weaker prices may ensue at saleyards however as TFI make arrangements to handle the supplies they had booked up for January.