Low yields weighing on the market

The market was again cheaper this week, with the large supply of “low yielding” wool continuing to attract discounts negatively impacting on the EMI as buyers struggled to fit these types into orders. While the drought impact has caused yields to be lower, this week in Mecardo Andrew Woods reported that yield was 3 – 4% lower compared to previous droughts.

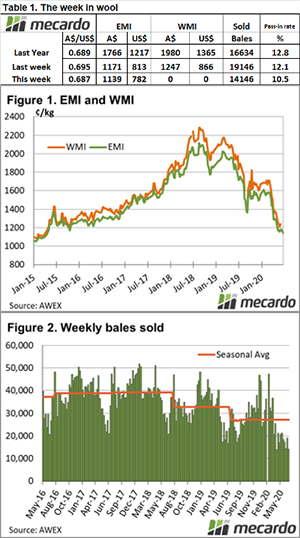

The Eastern Market Indicator (EMI) eased again by 32¢ this week to close at 1,139¢, while the Australian dollar also softened to US$0.69. The EMI in USD terms also fell 31¢ to 782¢. Fremantle again had a recess with the Western Market Indicator unchanged at 1,247¢.

Turnover was back below $20 mill to $18.50 million this week, however, the average bale value of $1,307 was $150 per bale up on last week, taking the season to date value to $1,941 million.

After growers withdrew 7.2% of the offering, just 15,800 bales came forward this week, and with a pass-in rate of 10.8%, 14,146 bales were sold.

It was noted this week that area planted to crops has increased year on year, with NSW up 95% on last year to 3.7 million hectares. (Read about this here on Mecardo).

This is confirmation of our concerns that the continued shift to grain production will continue now that the drought has broken, with the challenge for Merino sheep to regain lost acres going to be difficult. Any increase in wool supply in the medium term is likely to be modest at best.

The Crossbred sector ended a positive run with across the board falls of 20 cents.

Cardings proved more resilient despite Sydney reporting a 16-cent fall, Melbourne was dearer by 7 cents.

The week ahead

Next week Fremantle resumes and all centres sell on Tuesday & Wednesday with 30,240 bales on offer.