No post Easter price spike

There was no post Easter price spike this week, with processors seeming to have their supplies booked up well in advance. Saleyards were well supplied, and the good news, again, is that prices remain relatively strong despite plenty of lambs and sheep being on offer.

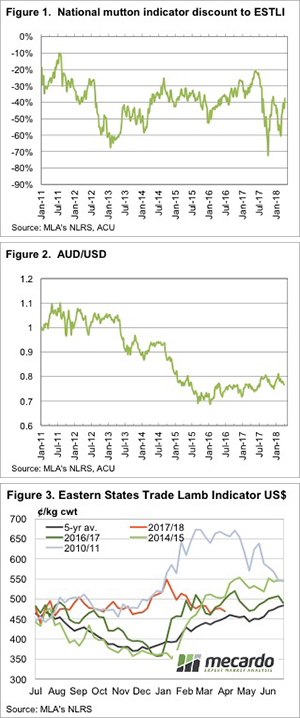

Lamb prices eased marginally this week, and mutton prices were up a bit. The result has the National Mutton Indicator (NMI) sitting close to an 8 month high in relative terms. Figure 1 shows the NMI is now at a 38% discount to the Eastern States Trade Lamb Indicator (ESTLI), which is just below the mark set in December.

The NMI discount might be strong relative to the last 8 months, however strong supplies see it still sitting 8 percentage points below this time last year.

It’s interesting given the low sheep offtake shown in this week’s analysis article that this year mutton has been more discounted than during the flock liquidation of 2014-15. Obviously, lamb prices are a lot higher and this appears to be putting some pressure on the mutton discount, despite being in the midst of a flock rebuild.

The Aussie dollar has weakened recently (figure 2), this should be providing support for export lamb values in our biggest markets. The ESTLI in US dollar terms is now looking not that expensive. Figure 3 shows USD prices were higher last year, and in 10/11 and 14/15.

This is another indication that perhaps there is room on the demand side for lamb prices to push higher, that is if supplies do start to wane over the coming month or two.

The week ahead

The lamb market is in reasonable shape. There will be upside if or when it rains, but the trade was shaping between the US and China has added in some uncertainty. There will be no direct impact on Australian lamb, but China’s tariffs on US beef and pork are likely to have some indirect impacts on our meat values. Which way our prices get pushed requires a bit more analysis.