One market two periods.

The grains industry has been fully focused on barley this week. This is hardly surprising considering the enormity of the impact of the Chinese import tariff. In this week’s comment, we will be giving barley a little break. Let’s look at what is happening in the wheat world.

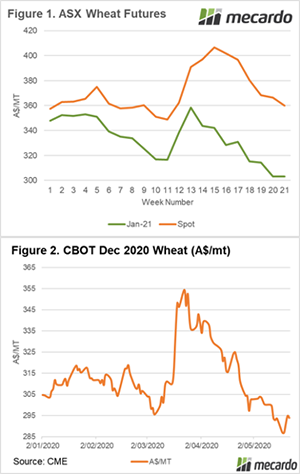

The local market is a tale of two time periods. The weekly average price for the old crop has declined A$6 week on week. Last week the old crop price averaged A$366, this week it has declined to A$360. As Australia moves on from the recent drought, pricing is destined to remain high until new crop supplies can fill the pantry.

The inverse between old and new has fallen A$6 to A$56. This remains high and as time ticks closer to harvest, there will be a point where the two pricing points converge. As we have discussed in many articles and podcasts, it is highly unlikely that new crop pricing levels will rise to meet old crop levels.

After falling two weeks ago, the new crop pricing level has remained solidly at A$303, albeit with very little activity.

As we move into the silly season, when grain market volatility increases, we will experience wild price swings. We have experienced a taste this week with CBOT wheat futures rallying from 509¢/bu to 527¢/bu. In local terms, December CBOT was unchanged from last week as a result of the higher AUD.

Next week?

Historically the May-July period has been one of great volatility. This is due to the northern hemisphere ‘weather market’. Any little move or concern will likely lead to large swings in pricing (both ways).