Planting and politics

Another relatively quiet week in the grain trade both locally and globally. In the past week, there have been further crop forecasts released, weather woes and political posturing from the Trump administration.

The wheat futures market has been on a downward trend since the start of the month (figure 1), and fell to as low as 398.5¢/bu. Overnight, futures rose around 5.75¢/bu (or A$2.8), it’s not enough to get overly excited about but any rise is better than a fall. The rise can be attributed to a recovery from falls in previous nights over concerns of posturing by Trump (more below), and concerns relating to cold weather. Although there will likely be issues with yield and quality in the US, it is still too early to get a realistic picture of any damage.

The International grain council (IGC) released updates to their projections, there were few surprises. Overall grain supplies are projected at their historic high  (2.6bn mt) for 2016/17, and old crop end stocks will largely cancel out lower production in the 2017/18 season. Our view still remains the same that a large supply shock is required to put fire under wheat prices to an excitable level.

(2.6bn mt) for 2016/17, and old crop end stocks will largely cancel out lower production in the 2017/18 season. Our view still remains the same that a large supply shock is required to put fire under wheat prices to an excitable level.

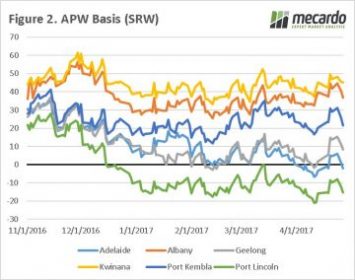

At a local level this week has been a short one due to the ANZAC day commemorations, which also traditionally has been a trigger for widespread crop planting around the country. Where it is not too wet to get machinery into the paddocks the country is for the most part in full swing. However, we have seen a sudden dip in basis levels across all port zones (figure 2), with Adelaide now following Port Lincoln into negative basis territory.

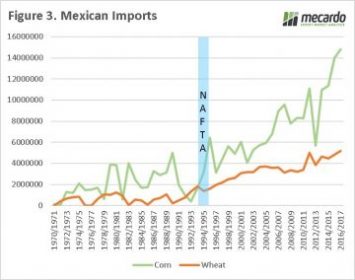

This week there were concerns that Trump was  ready to scrap the North America free trade agreement (NAFTA), however it was later announced that there would a ‘renegotiation’. Free trade agreements were at the centre of Trumps campaign, with fears that they negatively impacted on American jobs. The removal of NAFTA would be a worry for American grain growers, as trade with Mexico has drastically increased since 1994 when it was enacted (figure 3). The overwhelming majority of imports are from the US but in recent months it is speculated that Mexican buyers have been examining options from the South (Argentina & Brazil).

ready to scrap the North America free trade agreement (NAFTA), however it was later announced that there would a ‘renegotiation’. Free trade agreements were at the centre of Trumps campaign, with fears that they negatively impacted on American jobs. The removal of NAFTA would be a worry for American grain growers, as trade with Mexico has drastically increased since 1994 when it was enacted (figure 3). The overwhelming majority of imports are from the US but in recent months it is speculated that Mexican buyers have been examining options from the South (Argentina & Brazil).

What does this mean?

The grain trade will be keeping an eye on the weather in Europe and North America, in order to determine whether there are any major concerns.

At a local level, most farmers will be concentrating on getting a crop into the ground and marketing for old and new crop will largely be put to the back of the mind.

On a separate note growers holding old crop grain in silo bags in areas where mice are starting to become a ‘plague’ concern are advised to double check any bags for infestation.