Prices consolidate as supply wanes

After the big spike in lamb prices last week the market steadied. There was plenty of talk about the high prices making things hard for processors, but lamb and sheep slaughter still managed to remain at or above last year’s levels.

After the big spike in lamb prices last week the market steadied. There was plenty of talk about the high prices making things hard for processors, but lamb and sheep slaughter still managed to remain at or above last year’s levels.

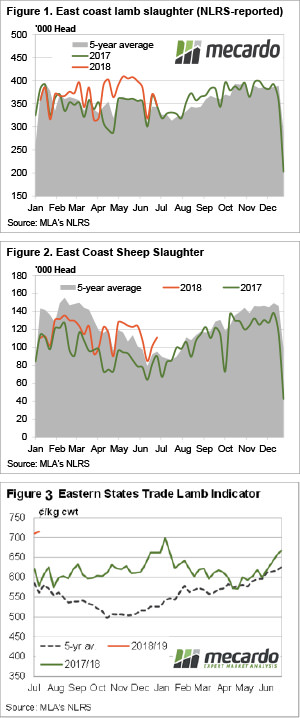

Figure 1 shows weekly lamb slaughter starting to follow the 2017 pattern very closely. The fall in slaughter last week was no doubt part of the reason prices rallied so strongly as it was the lowest full week slaughter for the year to date.

Like last year the tighter supply and higher prices are likely to trigger slowdowns in production, but the way lambs have been killed in April, May and June, there might not even be enough lambs for that.

Despite higher prices, sheep slaughter ramped up last week (Figure 2). This tells us that perhaps there is more money in sheep at the moment for processors. Combined sheep and lamb slaughter is still 5% higher than the same week last year.

The high prices last week drew some more lambs into yards, and this week it was heavy lambs which made the best money. The Eastern States Heavy Lamb Indicator gained 29¢ to hit a record of 735¢, while the ESTLI was up just 5¢ to 715¢/kg cwt (Figure 3).

In the West, prices eased 10% for both lambs and sheep, to 607 and 398¢/kg cwt respectively. At that price, sheep will start to work their way east, where prices in saleyards this week averaged 517¢/kg cwt.

What does it mean/next week?:

It looks like the 720-750¢ level is the limit for lamb processors. There were some pens of lambs reportedly making 800¢ this week though, and these were the highly sought after well-finished lambs. There’s not many of them about at the moment. Interestingly, there might be potential for a little more upside for mutton.