Supply disruptions and Merino moves

Over a couple of weeks of supply disruptions, lamb and sheep markets have largely been treading water. There have, however, been some interesting moves in the Merino lamb category, if not in the prime lamb space.

Lamb slaughter rates plummeted last week as Good Friday took out a day’s slaughter and probably any Saturday morning shifts as well. Lamb slaughter was down 25%, which is obviously more than one day’s slaughter, so perhaps things are starting to tighten.

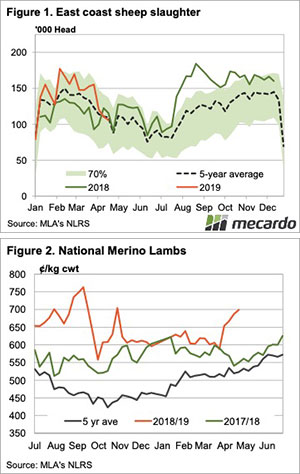

Sheep slaughter was down before Easter, having lost 32% since the last week in March. Good Friday only took out a further 4% (Figure 1), so there might have been a bit of a shift back to sheep.

Lamb and mutton markets were largely steady this week, with the Eastern States Trade Lamb Indicator (ESTLI) down 5¢ to 721¢/kg cwt and the East Coast Mutton Indicator losing 5¢ to 506¢/kg cwt.

The only real movement in the east coast indicators this week came from Merino Lambs. Figure 2 shows the East Coast Merino Lamb Indicator stopped just under 700¢ at 692¢/kg cwt. Merino lambs saw a gain of 29¢ and sit 160¢ above the same time last year. We are probably seeing tighter supply from the ordinary season, combined with stronger demand for Merino producers looking to restock.

There has been some good rain in western NSW this week, which while not drought-breaking, is the best they’ve had for some time. There might not be many sheep left out there but it can only be good for demand.

Next week?:

Next week will get back to more normal supply with full weeks resuming. There is still no real rain on the forecast but the recent move in sheep supply might be a pointer to what is to come, for both sheep and lambs. Forward prices are starting to move towards 800¢ for June and July, but will it be enough?