The dollar discount.

It must be hard being a currency forecaster, because they rarely seem to get it right. In this weeks grain market commentary we take a look at futures, currency and basis.

The futures market has provided somewhat of a price recovery since the middle of  December, when the spot contract switched to the March delivery. In figure 1, I have produced a fancy animation to show both the futures in ¢/bu and A$/mt. The futures contract has made a steady rise (up %), however when converted into A$, we can see that prices have largely gone sideways.

December, when the spot contract switched to the March delivery. In figure 1, I have produced a fancy animation to show both the futures in ¢/bu and A$/mt. The futures contract has made a steady rise (up %), however when converted into A$, we can see that prices have largely gone sideways.

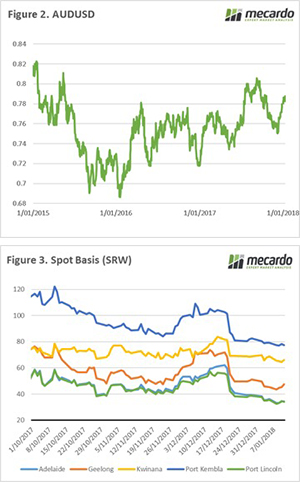

This lack of upward movement is because of an appreciating Australian dollar, this can be seen in figure 2. This has been caused by the recent release of bearish US CPI figures, pointing to the delay of interest rate hikes there, and some stronger economic data out of Australia in the form of improved employment figures and robust retail spending in the lead up to Xmas.

Basis levels have stayed relatively stable during the first two weeks of January, however basis remains on a tight balance. Will a strong finish to sorghum drop feed grain demand, or will the ABS downgrade to the 16/17 crop and resulting fall in carry give a floor to pricing?

Please note this comment was produced last night, and will not consider any changes overnight.

Next week

The WASDE report will be due overnight, along with US planting numbers. It is doubtful that we will see much to sway the markets, but I will keep an eye and if anything interesting comes up, I will report on Tuesday.