The good, the bad and the ugly

The grain market is one of the most interesting to be involved in. There is always ups and downs, always something interesting happening to change the direction of prices. This week is no exception with some big moves both internationally and locally.

At global level, we have seen further deterioration of Chicago wheat futures, with the spot market falling to as low as 474¢/bu, from a high at the end of June of 539¢/bu (figure 1). The market has lost 3/4 of its gains in ¢/bu since the rally in the end of June. The fall in SRW wheat is not unexpected as weather issues around the world are more a quality than quantity issue at present, and with beneficial rains being received throughout the US, risk to this crop has reduced and priced into the market.

At global level, we have seen further deterioration of Chicago wheat futures, with the spot market falling to as low as 474¢/bu, from a high at the end of June of 539¢/bu (figure 1). The market has lost 3/4 of its gains in ¢/bu since the rally in the end of June. The fall in SRW wheat is not unexpected as weather issues around the world are more a quality than quantity issue at present, and with beneficial rains being received throughout the US, risk to this crop has reduced and priced into the market.

When we however look at the futures converted to A$/mt, the losses have fallen well below the pre-rally period to $220 for spot and $230 for the December contract. This is due to the rise in the A$ which has been a surprise to many. The majority of analysts have been calling the A$ overvalued for the past 18 months, however it never fails to surprise. In the past week, we have seen the dollar rise due to continuing negative sentiment from the US, however, continued firming in the wider commodity market (iron ore etc) has seen support levels firm.

At a local level, there has been good news, with many in the cropping belts receiving much needed rainfall and forecasted falls due in the coming days. Let’s hope the BOM are correct, as there are a lot of expectations resting on these forecasts.

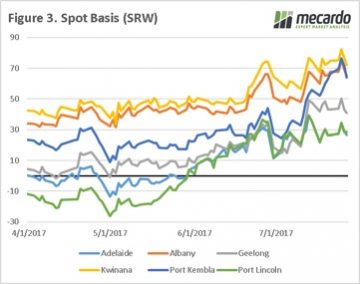

As the concerns continue with the Australian crop, basis levels have continued to stay strong (figure 3), providing good flat price opportunities for growers. As volume is likely to remain depressed this season, basis levels would be expected to continue to remain on the higher end of the range.

Next Week

The focus will be on the weather. What will the results be of the crop in the northern hemisphere, and as we go into August will we maintain the current crop potential?

The forecast is for drier conditions for the next three months, will we see further downward revisions?