US turmoil creates a headwind for Aussie cattle

Key points:

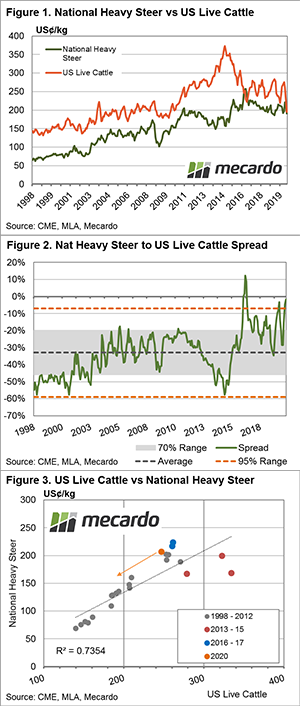

- Since the start of the year, US Live Cattle futures have declined by 30% to trade below 200US¢/kg on a live weight basis this week.

- The spread discount between Australian Heavy Steer prices and US Live Cattle futures has narrowed from a 28% discount in January to a 2% discount this month.

- A recovering AUD has placed further pressure on domestic Heavy Steer prices and continued weakness in US cattle markets could see local prices ease toward 275¢/kg lwt in the coming months.

The Australian cattle market can march to its own drumbeat from time to time, particularly when local climatic factors and the domestic supply situation override offshore influences. However, there is only so far they can deviate and usually the aberrations from the global situation are short-lived.

Since January US Live Cattle futures have been sold off aggressively falling nearly 30% from 275US¢/kg to trade just under 195US¢/kg this week, on a live weight basis. During the early phase of the price collapse in US Live Cattle futures, the Australian dollar was also being sold off which acted as an insulator for Australian cattle producers.

The lower value of the Australian dollar meant that domestic cattle prices didn’t have to come under pressure to remain competitive. However, in the last month the AUD has regained some strength moving from the mid 50US¢ level to the mid 60US¢ level, placing pressure on domestic cattle prices as the US Live Futures market continues to head south.

Figure 1 highlights the relationship between US Live Cattle futures and the National Heavy Steer Indicator in US¢/kg terms and it shows that with the ongoing weakness in US cattle markets and a recovery in the A$ the normal discount that Australian cattle markets have to the US has come under significant pressure.

Indeed, on a monthly basis, the National Heavy Steer to US Live Cattle futures price spread has narrowed from a 28% discount in January to a 2% discount this month (Figure 2). Analysis of the historic spread behaviour shows that since 1998 the monthly average spread has been a 33% discount, with the spread trading between a 20% to 46% discount for 70% of the time. Furthermore, movements beyond a 7% to 59% discount range would be considered extreme.

Figure 3 demonstrates the annual average price correlation between US Live Cattle futures and the National Heavy Steer in US¢/kg terms. Dry climatic conditions in Australia can see local prices deviate from the normal relationship (as indicated by the line of best fit between the annual data points) such as that which occurred during the 2013-15 seasons.

Similarly, wetter conditions or times of tight supply in Australia can see the local prices move towards a narrow discount spread or sometimes even to a premium spread to the US prices for a short period of time. This occurred most recently during the 2016/17 seasons and is also present during the current season.

What does it mean?

As of this week, US Live Cattle futures are trading below 200US¢/kg. However, as an annual average they are sitting at 245US¢/kg. If US Live Cattle futures remain sub 200US¢/kg for an extended period this will begin to see the annual average drift leftward (as per the path of the orange arrow (Figure 3).

Furthermore, if the AUD continues to probe higher this will add further pressure to domestic heavy steer prices. In USD terms the Australian National Heavy Steer is sitting at 192US¢/kg lwt. US Live Cattle futures remaining under 200US¢ could see it move closer to 175US¢, which equates to around 275¢/kg lwt in Aussie dollar terms based on an A$ at 64US¢.