USDA launches nuke, and brings the fire and fury

In the past week there has been significant posturing from both the Donald, and North Korea threatening to bring ‘fire and fury’ upon one another. It looks like the USDA might have fired the first salvo, with the release of the August WASDE report. In this week’s comment, we will look at what the fallout has been.

In the past week there has been significant posturing from both the Donald, and North Korea threatening to bring ‘fire and fury’ upon one another. It looks like the USDA might have fired the first salvo, with the release of the August WASDE report. In this week’s comment, we will look at what the fallout has been.

The World Agriculture Supply and Demand Estimates were released overnight. The reports in the middle of the year can provide some surprises, this is due to the fact that this period of time clarity is being achieved on the northern hemisphere market. This month’s report did not disappoint in that respect.

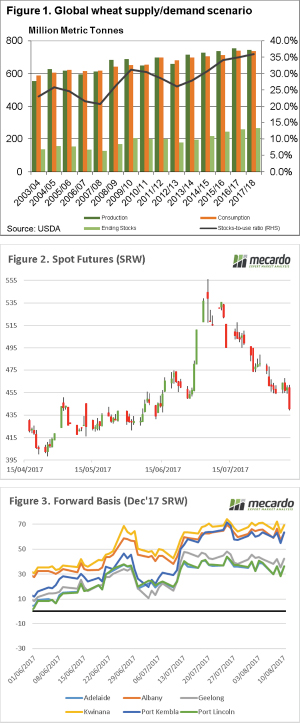

In articles in recent weeks, and presentations around the country I have commented that wheat quantity is not the biggest issue in the world. The main concern faced is quality, there are tightening stocks of high protein wheat around the world. This is reflected in the USDA report, which shows that wheat ending stocks for this year are to increase by 2% to 264.69mmt (Figure 1).

This is the highest world stock levels in history. Many may discount this number by the fact that China hold 48% of the world’s stocks. When we remove Chinese stocks, world stocks are still high. Since 1960, world stocks excluding China have only been higher in 8 seasons.

The report was more bearish than many commentators had expected, this has resulted in overnight prices diving (figure 2). In A$, the Chicago futures spot contract fell around $7, and have fallen A$55 since they mushroomed in late June/early July.

At a local level basis levels have remained somewhat stable over the past few weeks (figure 3) as buyers become reluctant to purchase at higher levels, and recent rains increase a small amount of confidence. Although there is still quite a way to go until harvest, and the crop could easily go either way.

Next Week/What does this mean?

The trade will be continuing to assess the impact of issues on the northern hemisphere, but as each week progresses more clarity is achieved and if nothing major happens upside (on low protein) is limited.

The key factor will be if Australia can achieve high protein wheat this harvest, and the rest of the world has a deficit then we are looking down the barrel of strong premiums. If the rain continues, and low proteins emerge from our crop then our prices and local basis will largely be driven by the domestic market.